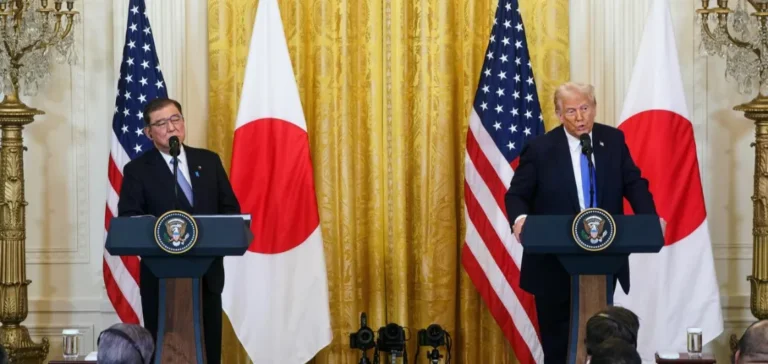

U.S. authorities confirmed a reduction in tariffs applied to Japanese imports, particularly in the automotive sector. The rate, previously set at 25%, has now been reduced to 15%. This measure is part of a large-scale bilateral agreement that includes a $550 billion Japanese investment commitment in the United States, expected to impact industrial and energy sectors.

A structured tariff framework

The new taxation scheme sets a 15% threshold on nearly all Japanese products entering the U.S. Specific provisions apply to automobiles, aerospace, generic pharmaceuticals, and certain strategic natural resources. This reform aims to strengthen U.S. exports and reduce the trade imbalance between the two economies.

In parallel, Tokyo is granting new market access to U.S. producers. Aerospace, agriculture, energy, and industrial goods are expected to benefit from simplified procedures and improved accessibility.

A stronger agricultural and energy component

The agreement foresees a 75% increase in Japanese imports of U.S. rice. Purchases will also include corn, soybeans, fertilizers, and bioethanol, totaling an estimated $8 billion annually. Japan is also considering expanding imports of U.S. ethanol, particularly for aviation fuel production, depending on domestic regulatory developments.

American beef and pork producers will gain better access to the Japanese market, as quota restrictions that previously limited volumes are eased. Energy remains central to the agreement, with discussions focusing on increased deliveries of liquefied natural gas (LNG) and related products.

Japanese capital targeting U.S. infrastructure

The Japanese investment plan, valued at $550 billion, covers areas identified as priorities by Washington. These include energy infrastructure, modernization of the power grid, critical minerals extraction, and both commercial and defense shipbuilding. The pharmaceutical, medical, and semiconductor industries are also included in this framework.

U.S. authorities will directly oversee project selection to ensure job creation and the strengthening of local industrial capacity. Japan has also agreed to recognize the compliance of U.S.-made vehicles with its safety standards without requiring additional testing.

Strategic scale in bilateral trade

Japan remains one of the United States’ leading trading partners, with exports exceeding $145 billion in the past year. Automobiles account for more than one-quarter of these flows, placing the sector at the core of the bilateral relationship. The tariff cut is expected to directly affect this industry, while Japan’s financial commitments mark the beginning of a new phase of investment spanning energy, industry, and aerospace.

These measures highlight the shared determination of Washington and Tokyo to strengthen their economic ties. Companies involved will now need to assess how the new tariff framework and capital flows will influence their strategies in the medium and long term.