Turkey is considering acquiring stakes in gas projects in the United States to strengthen its liquefied natural gas (LNG) supply chain. Turkish Minister of Energy and Natural Resources Alparslan Bayraktar stated that talks are ongoing with several American oil companies, including Chevron and ExxonMobil, regarding potential investment deals.

Objective: securing supply and strengthening the value chain

The minister confirmed that Turkey is set to receive around 1,500 LNG cargoes from the United States over the next ten to fifteen years. Within this framework, the country is exploring upstream investments to reinforce its position in the energy value chain while securing long-term imports.

Bayraktar also highlighted ongoing cooperation with US-based Continental Resources on unconventional production methods, including hydraulic fracturing. Turkey has already signed multiple long-term agreements with American and international companies covering LNG purchase and resale rights.

Focus on Southern Europe and Ukraine

Ankara aims to leverage its regasification capacity to export gas to Southern Europe and Ukraine. Bayraktar noted that the current interconnection with Bulgaria, with a capacity of 3.5 billion cubic metres (bcm), constitutes a bottleneck. He estimated that doubling this capacity would significantly improve energy supply for the region.

The stated goal is to reach a maximum export capacity of approximately 10 bcm to Southeast Europe. Ongoing discussions involve the Ukrainian company Naftogaz and the Turkish firm BOTAS (Boru Hatları ile Petrol Taşıma Anonim Şirketi – Turkish Petroleum Pipeline Corporation) to develop the required infrastructure.

Regional ties and US pressure on Russian oil trade

Last month, Ukrainian President Volodymyr Zelenskyy visited Turkey, where energy cooperation featured prominently. Bayraktar confirmed that Ukraine requested Turkish support for securing gas supplies, particularly by using Turkey’s underground storage capacity.

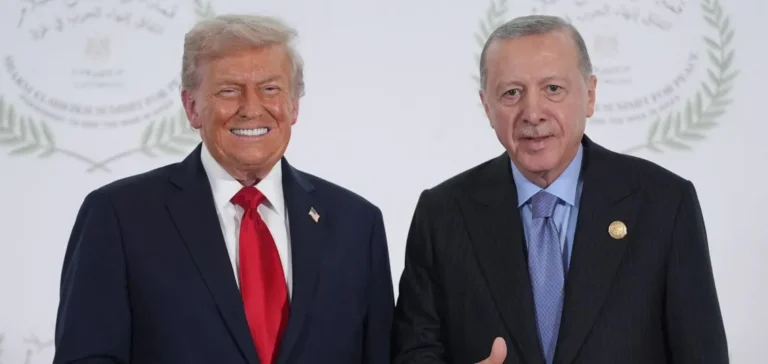

In this context, former US President Donald Trump tied potential easing of sanctions against Turkey to a reduction in its trade of Russian oil. This statement comes as Turkey seeks to diversify its supply sources and deepen energy ties with the United States.

Expansion of Turkey’s LNG infrastructure

Turkey currently has a regasification capacity of 32 bcm per year, with an estimated surplus of 10 to 15 bcm potentially available next year. The minister stated that two additional Floating Storage Regasification Units (FSRU) will be added to the existing three to further increase intake capacity.

Bayraktar noted that this capacity could also be made available to other countries. Egypt, for instance, could lease Turkish infrastructure during summer months for five to six months. Other countries, such as Morocco, may also use the system to optimise their seasonal LNG supply.