The future of New Caledonia’s nickel industry, and the survival of its three ailing metallurgical plants, depends above all on how the island’s energy equation is resolved, according to participants at meetings held in Paris this week.

The Energy Future of New Caledonian Nickel: A Survival Issue in the Face of Soaring Prices

At a time when the price of strategic raw materials such as nickel is soaring on world markets, New Caledonia’s three nickel refining plants are weighed down and their survival threatened by their production costs and lack of competitiveness, according to an official report published in August. All players in the industry, including elected representatives from both the independence and loyalist parties, industrialists and government bodies, met this week to try to “create a common vision” and a “new model” for the nickel industry, according to government sources, with the aim of avoiding an industrial crash.

“The main issue for the future of the New Caledonian nickel industry is energy,” a member of the cabinet of the Minister for Energy Transition, Agnès Pannier-Runacher, who attended the meetings, told AFP. We need to reduce the exorbitant energy bills of our factories.

“It’s a matter of survival,” adds an industry source.

The extraction and refining of nickel, the island’s main resource, consumes “75 to 80% of the electricity consumed in the territory”. And the energy costs of the three plants “can be twice as high as those of their Indonesian competitors”, says the report by the Conseil général de l’économie and the Inspection générale des finances.

Harnessing Extraordinary Potential: New Caledonia’s Quest for Green Energy

However, the “rock”, as the archipelago is known, has no infrastructure enabling it to produce low-cost energy. With the exception of the Yaté dam, which accounts for less than 10% of its total consumption, electricity is mainly dependent on coal or imported oil. Part of the discussions focused on how to develop new autonomous sources of electricity, but also on the need to produce green electricity to help the industry decarbonize and meet European climate targets, a government source summarized.

“The meetings moved things forward on both subjects. Decarbonization wasn’t necessarily a priority for everyone just a few weeks ago,” notes a participant who does not wish to be identified.

Ultimately, according to the plan under discussion, New Caledonia could increase its renewable energy production to 70% “by betting on its extraordinary sunshine potential and its land potential”, while retaining 30% of its energy from thermal power plants fuelled by imported gas, he added. But for the three plants to become profitable, an investment of 4 billion euros would be needed to create two pumped-storage power stations (STEP), according to the Caledonian grid operator Enercal.

Energy Storage: A Crucial Investment for New Caledonia’s Nickel Industry

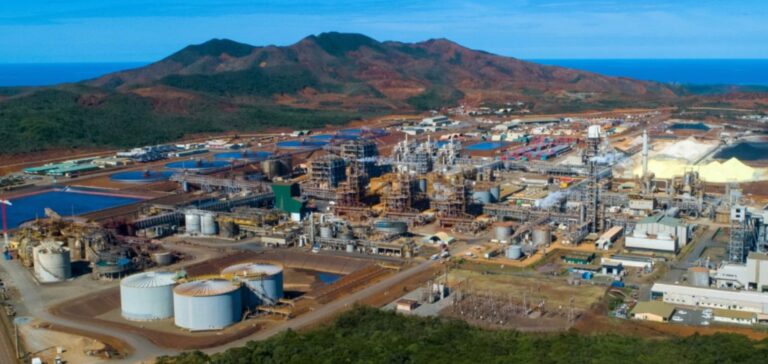

These dam-like infrastructures are designed to store photovoltaic energy – which is intermittent – so that it can be used when needed. One would be built in the north of the island to supply the KNS Koniambo plant, owned 51% by a public shareholder and 49% by the Glencore trading group. The second would go south, into the Tontouta valley, to supply the Société Le Nickel (SLN) plant in Nouméa, whose majority shareholder is the Eramet group, and the Prony Resources (PRNC) plant at the southern tip of the island, in which the Trafigura trading group holds a 19% stake.

Before signing a cheque, the French government will have this scheme and the amount of the bill assessed by the Commission de Régulation de l’Energie (CRE) in the coming months, says the Energy Transition cabinet. Only the Prony Resources plant produces class 1 nickel, suitable for batteries. She signed a high-profile contract with Tesla.

The other two plants, which produce class 2 nickel for stainless steel, also require investment to enter the battery market, estimated at 250 million euros for the northern plant and 20 million euros for the SLN plant, according to the office of Industry Minister Roland Lescure. A further meeting of the nickel working group is scheduled to take place “before the end of the year”.

Why does it matter?

In financial terms, the future of the nickel industry in New Caledonia is closely linked to the resolution of its energy problems. The massive investment required to develop sustainable, profitable energy infrastructures represents a considerable challenge for the island and its industrial partners. The nickel sector is crucial to New Caledonia’s economy, and its future competitiveness could impact not only local jobs but also international commodity markets. From the point of view of European climate objectives, the transition to cleaner energy is a step in the right direction, but it requires substantial investment. The future of this industry is therefore a subject to be watched closely by observers of business, finance and the energy market.