China has implemented new fiscal measures in response to the increase in customs duties imposed by the United States. These measures mainly focus on agricultural products, with additional tariffs ranging from 10 to 15% on imports from the US. This decision follows the rise in US tariffs on Chinese imports, introduced as part of escalating trade tensions.

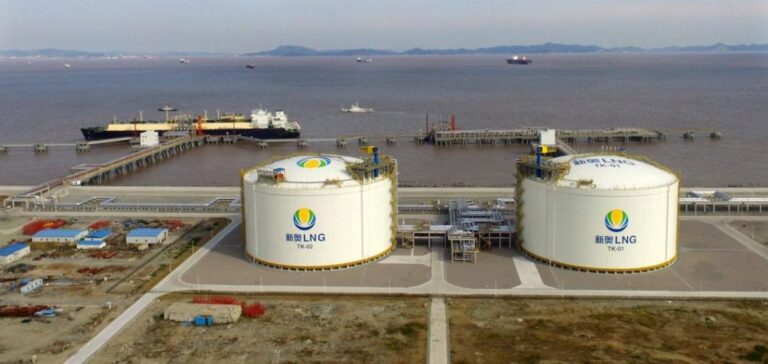

However, energy products, including liquefied natural gas (LNG), have been explicitly excluded from this set of measures. This exclusion follows the imposition of additional tariffs on US LNG and coal in early February, as well as an increase in duties on crude oil. China’s decision not to apply new tariffs on LNG could have significant implications for the global energy market, given China’s strategic position as a key importer of the product.

The impact of these decisions is already being felt in the volumes of LNG imported from the United States. Before the new tariffs came into effect, China had imported only one LNG cargo from the US, a figure significantly lower than the monthly average of three cargoes observed at the end of the previous year. Chinese companies appear to be diversifying their sources of supply, turning to non-US suppliers in order to reduce their exposure to tariff hikes.

Major Chinese companies in the LNG sector, such as PetroChina, Sinopec, and CNOOC, have long-term contracts for a total volume of 25.6 million tonnes per year. However, imports from the US account for only a small portion of these volumes. In fact, only 4.2 million tonnes of US LNG have been delivered since the contracts began.

Supply strategy and impact on trade flows

In response to changes in tariffs, China is adapting its LNG supply strategy. This shift could disrupt global supply chains, particularly if trade tensions persist and further fiscal measures are implemented. The LNG sector may thus face pressure, with a probable reorientation of trade flows towards non-US suppliers.

Uncertain outlook for US LNG imports

The future of US LNG imports remains uncertain. Observers expect that the evolution of US fiscal policy will play a key role in shaping trade flows in this sector. Chinese importers seem poised to further reduce their purchases of US LNG if these tariff measures remain in place. The coming months will be crucial in observing the impact of these decisions on the LNG market and on international trade relations.