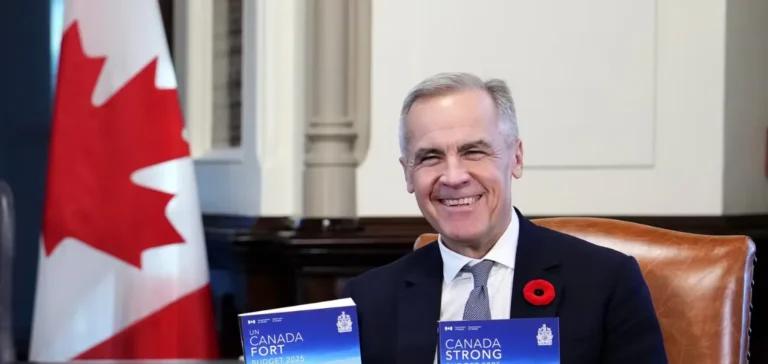

Prime Minister Mark Carney has announced a new wave of major projects totalling over $56 billion in investments, aimed at strengthening Canada’s position as a global energy leader and upgrading the country’s strategic infrastructure. These projects are part of the agenda of the Major Projects Office, created to accelerate the implementation of key national initiatives.

Northwest corridor development and power grid expansion

Among the projects under review is the Northwest Conservation Corridor, which stretches through British Columbia and the Yukon. This strategic corridor, located above significant critical mineral reserves, will facilitate resource extraction while connecting remote regions through upgraded energy and digital infrastructure.

Supporting this development is the North Coast electricity transmission line, designed to connect the corridor to the national grid. The Canada Infrastructure Bank has granted a $139.5 million loan to BC Hydro for initial phases. The line will enable the deployment of industrial initiatives, including the Ksi Lisims liquefied natural gas (LNG) terminal, and is expected to reduce emissions by up to three million tonnes annually.

LNG expansion and export infrastructure

The Ksi Lisims LNG terminal, located on Pearse Island in British Columbia, would become Canada’s second-largest LNG facility. Led by the Nisga’a Nation, the project is expected to attract nearly $30 billion in investment. It includes an 800-kilometre gas pipeline and a dedicated 95-kilometre power line to supply the plant with electricity.

This development is part of a broader plan to more than double Canada’s LNG export capacity, alongside the previously submitted LNG Canada Phase 2 project.

Critical minerals: three mining projects under review

The Crawford nickel project, led by Canada Nickel in Timmins (Ontario), targets the world’s second-largest nickel reserve. It promises high-quality, low-carbon nickel production, with emissions forecasted at 90% below the global average. Total investment is projected at $5 billion.

In Québec, Nouveau Monde Graphite’s Matawinie open-pit mine will supply defence applications and battery supply chains, linking with a planned battery materials plant in Bécancour. The initiative is expected to create over 1,000 jobs and attract $1.8 billion in capital.

Meanwhile, the Sisson mine in New Brunswick, owned by Northcliff Resources, will focus on tungsten extraction — a critical resource in high-strength steel production and defence. The project responds to a global demand concentrated among few producers and positions Canada as a reliable supplier.

Northern infrastructure and energy sovereignty

The hydroelectric project led by Nunavut Nukkiksautiit Corporation in Iqaluit aims to eliminate the city’s reliance on 15 million litres of imported diesel annually by establishing a local, emission-free power source. Fully owned by Inuit interests, the project supports energy sovereignty in Nunavut and local job creation.

These projects fall under a broader national investment plan that has committed over $116 billion through two project rounds. In parallel, Canada has launched 26 partnerships and funding initiatives for critical mineral supply chains worth $6.4 billion.