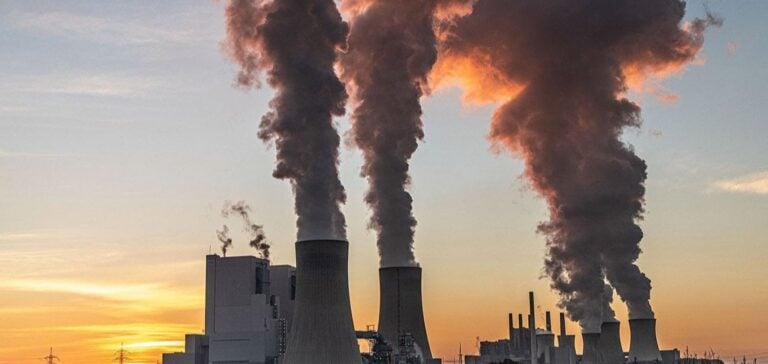

Energy dependency in the Philippines and Indonesia is increasing, with a significant rise in the share of coal in electricity production. In 2023, Indonesia reached a record 61.8% of its electricity generation from coal, according to Ember, a London-based think tank. In the Philippines, this share also increased to 61.9%. Despite this heavy dependence, Manila is speeding up the development of energy transition projects.

Despite a $20 billion international financing agreement, the Just Energy Transition Partnership (JETP), designed to help Jakarta reduce its dependence on coal, the transition to cleaner energy sources remains slow. Coal, a major source of CO2 emissions, continues to dominate due to growing energy demand in both countries.

Lagging renewable energies

Meanwhile, the Philippines and Indonesia are lagging behind in the development of renewable energies. The share of wind and solar power in electricity generation remains low, at just 3.2% in the Philippines and 0.3% in Indonesia, well below the regional average of 4.4%. This slow progress is worrying at a time when the region should be stepping up its efforts to meet global climate targets.

Impact of energy production

Electricity generation from other sources, such as bioenergy and gas, has declined, reinforcing dependence on coal. In Indonesia, hydroelectric production fell by 10% last year, probably due to the drought, putting further pressure on coal to fill the energy gap.

The Philippines is aiming for 35% renewables in its electricity production by 2030, while Indonesia has committed to 44% by the same year. However, without a significant reduction in the share of coal, these targets may be difficult to achieve.

Perspectives and challenges

To reduce CO2 emissions and meet climate commitments, the Philippines and Indonesia need to accelerate their energy transition. The International Energy Agency (IEA) recommends the cessation of all electricity generation from uncaptured coal by 2040 to achieve the goal of zero net CO2 emissions by mid-century.

Both countries face considerable challenges in diversifying their energy mix and increasing the share of renewable energies. This will require substantial investment, political reform and a greater willingness to switch to more sustainable energy sources.