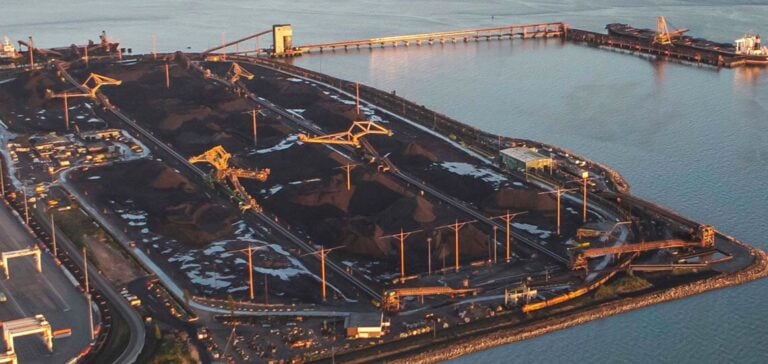

Coal exports from Westshore Terminals, one of the largest coal terminals on the west coast of North America, remain largely unaffected by the dockworkers’ strike in the region. The terminal at Roberts Bank, located in British Columbia, confirmed on November 4 that ship loadings and departures continue as scheduled, with no disruption to commercial flows to Asia and other international destinations.

Westshore Terminals benefits from a separate agreement with the International Longshore and Warehouse Union (ILWU) Local 514, signed in December 2023, which remains valid until January 2028. This agreement provides stability, allowing operations to continue independently of recent labor actions at other terminals in the area. According to Steven Read, president of Global Coal Sales Group, trains from Signal Peak Energy in the United States continue to deliver coal to Westshore via the Burlington Northern Santa Fe (BNSF) rail network, thereby maintaining the pace of exports.

Limited Effects of the Strike on Coal Terminals

The strike, initiated by ILWU on October 31, prompted an immediate response from the British Columbia Maritime Employers Association, which announced a lockout of all ILWU members at affected terminals. However, Westshore Terminals and Trigon Terminals, another coal terminal in British Columbia, appear largely unaffected due to their respective collective agreements.

Trigon Terminals, formerly known as Ridley Terminals and located in Prince Rupert, recorded a combined volume of thermal and metallurgical coal exports of 7.3 million tons in 2023, ensuring a steady flow to its international customers. These agreements have allowed both terminals to remain operational despite labor tensions, offering some continuity to coal supply chains on the west coast.

Outlook on Coal Prices and Demand

Coal price assessments for the western United States region reflect a slight decline despite the strike. On November 4, Platts, a division of Commodity Insights, reported a 40-cent drop in FOB (Free on Board) west coast prices for thermal coal at 5,750 kcal/kg NAR (Net As Received), positioning it at $99 per ton. This slight variation is influenced by several factors, including stable operations at Westshore and the absence of significant shipping delays to Asia.

Among the primary markets, Japan and South Korea remain the main recipients of Westshore’s exports. In 2023, the terminal shipped a total of 27.7 million tons, of which 13.4 million tons were destined for Japan and 7.3 million tons for South Korea. The continuity of coal shipments from the terminal should allow regular flows to Asia, meeting the steady demand for coal in these countries.

Managing Port Traffic in a Strike Context

The strike in British Columbia has led to adjustments in port traffic management within the region. The Port of Vancouver, in collaboration with other maritime entities, is working to optimize available anchorage zones for ships awaiting loading. According to officials, anchorage priorities are adjusted based on operational terminals to minimize congestion risks, although Westshore has indicated its willingness to consider adjustments should ships be redirected to its facilities.

If the strike continues, companies and port officials may need to consider additional adaptation plans to avoid any impact on the flow of Canadian coal exports. Currently, Westshore’s operational independence from regional union conflicts ensures uninterrupted exchanges with its international partners, maintaining steady coal deliveries.