Three people were killed and eleven children abducted in jihadist attacks in Cabo Delgado province, northern Mozambique. These events, which occurred in Palma and nearby Nangade, were confirmed by local sources and conflict-monitoring NGOs. Palma lies in close proximity to a major liquefied natural gas project led by French company TotalEnergies.

Palma once again targeted by insurgents

During the night of October 9 to 10, around fifteen armed insurgents entered several homes in Palma. According to a local military source, the attackers killed one person and abducted seven girls before capturing four boys fleeing the scene. The jihadist group Islamic State claimed responsibility for the attack via a statement issued shortly after the event. This marks the first incursion reported in Palma since the March 2021 attack that killed over 800 people and led to the suspension of TotalEnergies’ $20bn gas operations.

Increase in incidents across the province

Approximately 100 kilometres away, in Nangade, the attackers killed two civilians, set fire to a church and several homes, and looted properties before fleeing. These attacks are part of a rising trend in security incidents across Cabo Delgado and neighbouring Nampula provinces since the beginning of the year. More than 500 security-related events have been reported, including raids, killings, kidnappings, and looting.

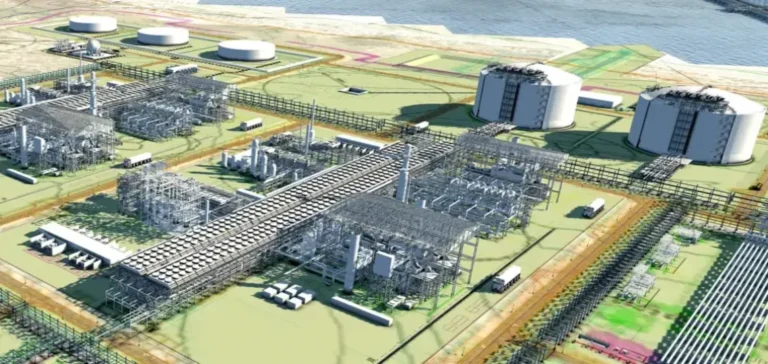

Persistent insecurity around gas investments

Cabo Delgado is home to large natural gas reserves, attracting significant international investment, including the $20bn liquefied natural gas project led by TotalEnergies. Since the 2021 attack, operations have been halted, and the renewed violence could further delay their resumption. A security expert working for an international NGO stated that there is likely a connection between the announcement of the project’s relaunch and the recent attack, highlighting ongoing risks in the area.

Humanitarian consequences and pressure on economic actors

According to data from the United Nations High Commissioner for Refugees (UNHCR), over 110,000 people have been displaced in Mozambique in 2025, including 22,000 in a single week in late September. Although vital to the national economy, gas infrastructure remains vulnerable amid a context where the Mozambican army and its regional allies, notably Rwanda, struggle to contain the insurgency. Security developments in the area remain a critical factor for future decisions by companies operating in Mozambique’s energy sector.