Helion Energy is upending established norms in the nuclear fusion sector amid a race between start-ups and technology giants. While Google recently signed a landmark 200-megawatt agreement with Commonwealth Fusion Systems for delivery in the 2030s, Helion is maintaining its aggressive target of 2028 to power Microsoft’s data centres. This technical, financial and operational challenge is raising questions among experts as the fusion industry attracts record investments.

A radically different approach in a heated sector

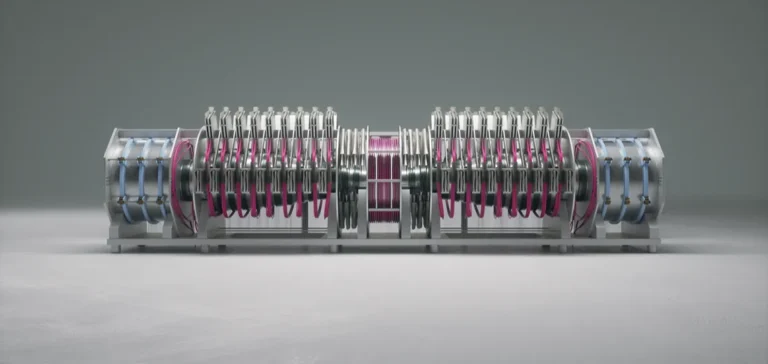

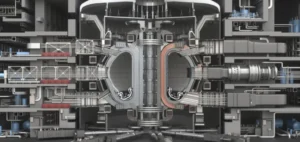

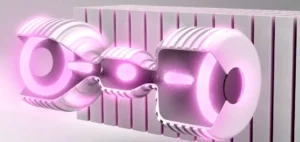

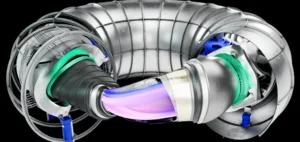

Helion’s field-reversed configuration (FRC) stands out from the dominant tokamak approach adopted by Commonwealth Fusion Systems, which has raised USD2bn. While CFS is betting on high-temperature superconducting magnets in a classic toroidal configuration for its SPARC reactor, Helion is pursuing an alternative path with its Orion reactor. The system operates on a pulsed magnetic compression principle at 1 Hz, propelling two plasmoids at more than 1.6mn kilometres per hour before their collision.

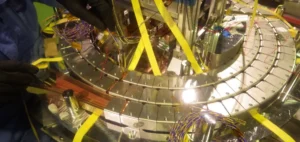

This architecture allows temperatures above 100mn degrees Celsius to be reached, with magnetic fields exceeding 10 Tesla. TAE Technologies, another major player with USD1.5bn raised and renewed support from Google in June 2025, is also following an FRC approach, but with a hydrogen-boron fuel that promises zero radioactive waste. The technological diversity reflects the sector’s immaturity and the absence of consensus on the optimal path to commercialisation.

The deuterium-helium-3 gamble versus conventional approaches

Helion’s choice of the deuterium-helium-3 cycle is the company’s boldest bet in a sector largely focused on deuterium-tritium. Commonwealth Fusion Systems and most competitors favour the D-T cycle for its lower ignition temperature, accepting the challenges posed by high-energy neutrons. Helion’s D-He3 cycle mainly produces charged particles that can be directly converted into electricity, eliminating 95% of neutrons and theoretically allowing direct conversion with 70% efficiency.

As helium-3 exists only in trace amounts on Earth, Helion is developing a complex production cycle via deuterium-deuterium reactions. The patented magneto-inductive recovery system is supposed to recover more than 95% of unused energy at each cycle. This approach remains unproven at commercial scale, in contrast to the tangible progress by TAE Technologies, which demonstrated simplified plasma formation with its Norm prototype in April 2025. According to results published in Nature Communications, this new approach reduces system complexity and should lower the construction costs of future power plants, although the potential savings are not yet quantified.

An economic model under competitive pressure

The 50 MW contract with Microsoft appears modest compared to the 200 MW Google has just secured from Commonwealth Fusion Systems for its Virginia facility. Constellation Energy will manage commercialisation for Helion, bringing its crucial regulatory expertise. Analysts estimate Microsoft will pay a substantial premium, potentially USD100-150 per MWh—three times current market prices—to ensure a continuously available decarbonised source.

With more than USD1bn raised, Helion lags behind the USD2bn for CFS and even TAE Technologies’ USD1.5bn after its USD150mn round in June 2025. Sector estimates put first-generation power plant construction costs at USD50-80mn per installed megawatt. The Orion plant therefore represents a minimum investment of USD2.5-4bn, requiring further funding rounds that the company has not yet announced.

Operational challenges amplified by sector acceleration

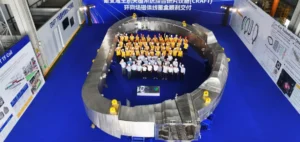

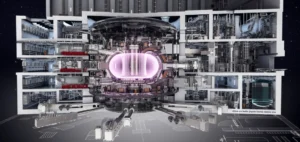

The Malaga site offers strategic advantages with direct access to the Rock Island dam infrastructure, but Helion faces fierce competition for talent. Commonwealth Fusion Systems is hiring extensively for its SPARC project near Boston, while TAE Technologies is simultaneously developing its Copernicus and Da Vinci prototypes. The market now has more than 50 fusion start-ups worldwide that have collectively raised USD7.1bn, creating wage inflation for plasma physicists and specialised engineers.

The Nuclear Regulatory Commission’s decision to regulate fusion under Part 30 benefits all players, but does not remove Helion’s specific challenges related to tritium and helium-3 management. The need for qualified staff—estimated between 800 and 1,000 employees—far exceeds the local talent pool. The supply chain for critical components remains embryonic, with lead times of 18-24 months for custom superconducting magnets.

A race against time in a transforming sector

Helion’s 2025-2028 timeline appears increasingly ambitious given sector realities. Commonwealth Fusion Systems, despite superior resources, is targeting the 2030s for its commercial ARC plant. TAE Technologies is planning its first Da Vinci plant prototype for the early 2030s. Only Helion is sticking to a 2028 deadline, raising questions about technical feasibility or a willingness to compromise on performance.

Recent agreements between technology giants and fusion start-ups—Google with CFS and TAE, Microsoft with Helion—signal an acceleration in energy demand driven by artificial intelligence. Data centres are expected to double their electricity consumption by 2030, creating a captive market for fusion if it can deliver. Helion’s failure to meet its timeline could not only result in massive contractual penalties but also cool investor enthusiasm for the sector as a whole. Between the promise of an energy revolution and relentless industrial realities, Helion Energy embodies both the hopes and the risks of this new race for commercial fusion.