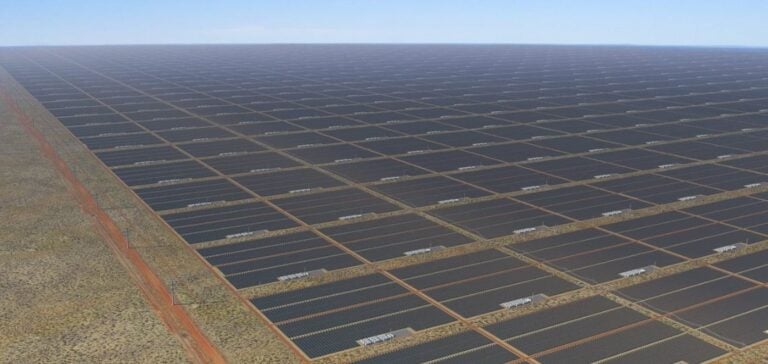

Australia recently gave the go-ahead for the construction of SunCable, a solar power plant that will become the world’s largest once completed.

Located in the Northern Territory, the project will cover 12,000 hectares and generate 6 gigawatts of electricity.

Of this output, 4 gigawatts will be used for domestic consumption, while 2 gigawatts will be exported to Singapore.

The facility is backed by technology entrepreneur Mike Cannon-Brookes and represents an investment of €21 billion.

SunCable should be operational by 2030.

Economic and logistical challenges

SunCable doesn’t just produce electricity.

The project also includes the storage of 40 gigawatts using high-capacity batteries, ensuring a stable energy supply.

In addition, it is estimated that this initiative will create over 14,000 jobs in northern Australia, boosting the local economy.

The export of 2 gigawatts to Singapore, which will cover 15% of the city-state’s energy needs, represents a strategic step forward for Australia in the Asian renewable energy market.

Regulatory Complexities and Authorizations

SunCable’s development, although approved by the Australian government, still has to pass a number of regulatory hurdles.

Singapore’s energy regulator and the Indonesian government, whose territorial waters will be crossed by the submarine cables, have yet to give their approval.

Discussions are also underway with the Australian indigenous communities affected by the project.

The final investment decision is expected in 2027, following an in-depth planning phase.

Australia’s strategic positioning

Australia, while remaining a major player in fossil fuels, is increasingly turning to renewable energies.

SunCable is part of a drive to diversify the country’s energy sources and strengthen its position in the global market.

Currently, renewable energies account for 32% of the country’s electricity production, while coal accounts for 47%.

The development of projects such as SunCable could enable Australia to gradually reduce its dependence on coal, while increasing its capacity to export clean energy.

This project, if it succeeds in overcoming regulatory and technical obstacles, could become a model for other nations seeking to combine local production and export of renewable energy.