Having experienced one of its worst energy crises this year in the wake of Russia’s invasion of Ukraine, Japan wants to accelerate the revival of nuclear power this winter to reduce its heavy dependence on imported hydrocarbons. But the government’s plans are likely to run into a series of obstacles. In Japan, the nuclear sector is still convalescent and controversial since the Fukushima disaster caused by a tsunami in 2011.

What is the situation?

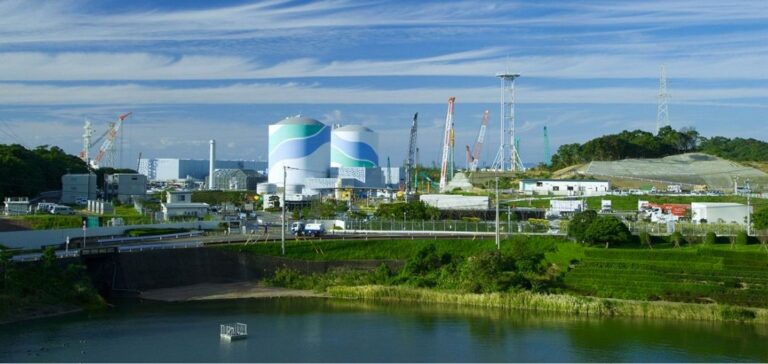

The entire Japanese nuclear power plant was shut down after Fukushima to reinforce safety standards. Reactors have been restarted since 2015. A total of ten have since been reconnected, out of 33 theoretically operable. For the moment, these ten reactors have never all been operating simultaneously, due to periodic inspections, maintenance shutdowns or additional work.

What are the government’s objectives?

Last summer, Prime Minister Fumio Kishida set a target of having nine nuclear reactors operating in the archipelago this winter, enough to cover about 10% of the country’s electricity consumption.

This first goal has been achieved, as several reactors have been reconnected in recent weeks. Mr. Kishida also hopes to see seven additional reactors restarted by the summer of 2023. It has launched a reflection on the construction of new generation reactors and proposed to extend the operating life of old power plants beyond the current limit of 60 years.

Japan is targeting a nuclear share of 20-22% of its electricity generation by 2030, up from 30% before Fukushima and 6.9% in the 2021/22 fiscal year ended in late March.

Nuclear power must also be used to meet Japan’s climate commitments, namely a 46% reduction in CO2 emissions in 2030 compared to 2013 and carbon neutrality by 2050.

Safety concerns

The government’s nuclear ambitions depend primarily on the goodwill of the Japanese Nuclear Safety Authority (NRA), an independent body established in 2012. “There will be difficulties” in restarting existing reactors, if only because some of them “have been shut down for a long time,” notes Tom O’Sullivan, an energy consultant with Mathyos Advisory in Tokyo, interviewed by AFP. And “given what is happening at the Zaporizhia nuclear power plant in Ukraine, I think the NRA has probably become more sensitive to the risk of terrorist attacks” on Japanese reactors, says this analyst.

Among the seven additional reactors the government hopes to restart by the summer of 2023 are two units at the giant Kashiwazaki-Kariwa plant in Niigata Prefecture (central Japan), whose gaping security breaches have caused scandal in recent years.

Is the population ready?

The Japanese public’s reluctance to use nuclear power has decreased since the war in Ukraine and the spike in energy prices, according to recent polls. But the opposition of power plant residents remains strong. Obtaining their consent will be another “key challenge,” Moody’s analyst Hiroe Yamamoto warned in a note.

A quick restart of the reactors will also depend on the local authorities involved and the popularity of Prime Minister Kishida next year, according to Nobuo Tanaka, chairman of the Japanese think tank Innovation for Cool Earth Forum (ICEF) and former executive director of the International Energy Agency (IEA).

But Mr. Kishida “is in trouble right now,” Mr. Tanaka said at a recent press conference, referring to scandals that have plummeted the popularity of his government since last summer. “Simply saying that we need nuclear power because of high energy prices may not be enough” to persuade the public of the merits of a sustainable revival of the sector, Mr. Tanaka warned, insisting on the need to discuss the substance and deal with sensitive issues such as nuclear waste management.