Oil prices are rising on Monday in the wake of an Opec+ meeting that maintained its current strategy, while the European embargo and Russian crude price cap by the G7, EU and Australia came into effect.

Around 10:30 GMT (11:30 in Paris), the barrel of Brent North Sea for delivery in February takes 1.78%, to 87.09 dollars.

Its U.S. equivalent, a barrel of U.S. West Texas Intermediate (WTI) for January delivery, rose 1.83% to $81.44.

On Sunday, during a brief meeting by video conference, representatives of the thirteen members of the Organization of the Petroleum Exporting Countries (Opec) led by Riyadh, and their ten allies led by Moscow, agreed to keep the course decided in October of a reduction of two million barrels per day until the end of 2023

“Even though there were fears that OPEC would surprise the markets,” the group “stayed the course, perhaps to avoid drawing the ire of Western leaders,” believes Stephen Innes of Spi, interviewed by AFP.

“Sometimes the best course of action is to do nothing,” agrees Stephen Brennock of PVM Energy, given the current uncertain climate in the oil market.

The group’s decision came on the eve of the entry into force on Monday of a new round of sanctions against Russia for its war in Ukraine, designed to directly affect the country’s financial windfall.

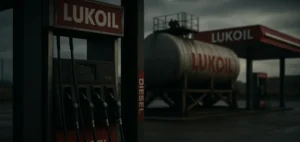

The EU embargo on Russian seaborne oil began Monday, cutting off two-thirds of its crude purchases from Russia.

The European boycott of Russian crude also coincides with the adoption by the EU, the G7 countries and Australia of a cap on Russian oil prices.

The mechanism adopted provides that only crude oil sold at a price of $60 per barrel or less will continue to be delivered, and that beyond that, companies based in the EU, the G7 and Australia will be prohibited from providing the services that enable shipping, such as insurance.

The Kremlin assured Monday that the cap would not impact Moscow’s offensive in Ukraine, warning against a “destabilization” of the global energy market.

Russia has also repeatedly warned that it will no longer deliver oil to countries that adopt this measure.

This new set of sanctions is expected to result in “a drop in the country’s oil production of around one million barrels per day,” says Stephen Brennock.

Opec+ said in a press release on Sunday that it was ready to meet “at any time” between now and then to take “immediate additional measures” if needed.

“In other words, it will recalibrate production levels as the Russian supply situation becomes clearer in the coming weeks,” Brennock continued, with the concrete impact of the measures against Moscow still unclear.