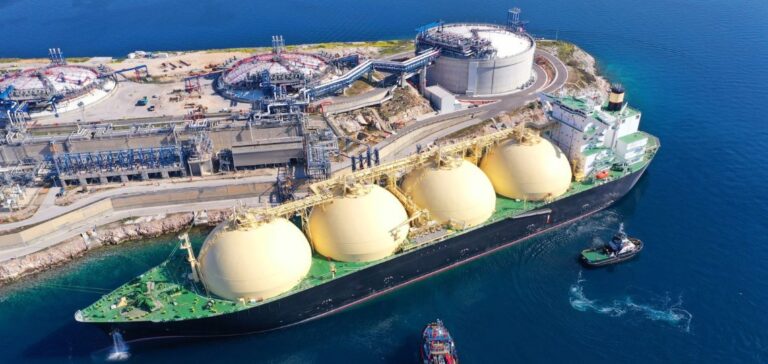

Japan, anticipating a drop in domestic demand for liquefied natural gas (LNG) due to the revival of nuclear power plants and the rise of renewable energies, is turning to Asian markets to sell its LNG surpluses. This strategy aims to maintain an annual import volume of 100 million tonnes of LNG, in line with government targets. Japanese companies such as Tokyo Gas, Marubeni and Sojitz are investing in energy projects in Southeast Asia, particularly in Vietnam, the Philippines and Indonesia.

Strategic Projects in Asia

Tokyo Gas recently announced a study for a 1.5 gigawatt LNG power plant project in Vietnam, and acquired a stake in a regasification terminal in the Philippines. At the same time, Marubeni and Sojitz launched a 1.8 GW LNG power plant in Indonesia. These initiatives are part of a broader strategy to secure energy supplies and develop LNG trading capacity in Asia.

Implications for energy security

Japan’s increased investment in LNG infrastructure in Asia is aimed at strengthening the country’s energy security and managing the risks associated with LNG surpluses. Yoko Nobuoka, senior analyst at LSEG, stresses that the development of trading capacities and the creation of an Asian gas market are crucial to this security. Japan’s active participation in more than 30 gas projects in countries such as Bangladesh, India and Malaysia bears witness to this ambitious strategy.

Evolution of LNG Demand

Japanese demand for LNG, down since the reopening of nuclear power plants and the adoption of renewable energies, led to an 8% reduction in LNG imports last year. Nevertheless, the Ministry of Industry (METI) has reiterated its plan to maintain LNG handling capacity at 100 million tonnes per year by 2030. Japanese companies, such as Tokyo Gas, are aiming to increase their LNG trading volumes to compensate for declining domestic demand.

Regional Perspectives and Climate Challenges

Japan plays a crucial role in Asian gas markets, especially with rising trade tensions with China, the world’s largest importer of LNG. Japanese LNG exports to third countries doubled to 31.6 million tonnes in 2022, largely thanks to upstream projects and supply contracts. However, climate activists criticize this reliance on LNG, arguing that Japan should invest directly in renewable energies to help Asian countries decarbonize.

Japanese investments in LNG import terminals in Southeast Asia, with a total capacity of 29.2 million tonnes per year, demonstrate a proactive strategy to stabilize energy supply and manage future surpluses. However, this approach is contested by groups such as Market Forces, who advocate a direct energy transition to renewables.

Analytical thinking

In conclusion, Japan’s strategy of investing in gas infrastructure in Asia is aimed at mitigating future LNG overproduction while strengthening regional energy security. This approach, while pragmatic, must nevertheless take account of climate issues and the growing pressure for an accelerated transition to renewable energies.