South Africa has decided to postpone the launch of its nuclear power plant project to better address legal concerns and improve public consultation.

The project, which aims to add 2,500 MW to the national grid, has been criticized for its lack of transparency, leading to protests from the Democratic Alliance (DA), now part of the government coalition, and several NGOs.

The Minister of Electricity and Energy, Kgosientsho Ramokgopa, therefore announced the temporary withdrawal of the official document authorizing the launch of the call for tenders, while he strengthened public participation and adjusted the report supporting the project.

This decision comes at a time when the country’s energy capacity is under strain, with a pressing need to increase production to avoid further blackouts.

The nuclear project is seen as a strategic response to this challenge, but the lessons of the past, notably the failure of the 9,600 MW agreement with Russia under President Jacob Zuma, oblige the government to act with impeccable transparency.

Electricity market reforms and legal issues

At the same time, President Cyril Ramaphosa’s signature of the Electricity Regulation Amendment Act marks a significant turning point in the regulation of South Africa’s electricity market.

This law aims to introduce more competition into a sector historically dominated by Eskom, the state-owned operator.

The aim is to make the market more dynamic and improve the efficiency of electricity distribution, an imperative for an economy heavily impacted by power cuts.

The postponement of the nuclear project, although seen as a temporary setback, is part of a wider strategy to restructure the energy sector.

The delay, estimated at between three and six months, will ensure that the tendering process is protected from any subsequent legal recourse, a necessity to avoid the mistakes that marked the aborted agreement with Russia.

The reforms underway underline the government’s commitment to creating a more competitive and transparent market environment.

However, the need to meet growing energy needs remains a major challenge, and industry professionals are keeping a close eye on developments in this area, aware of the potential impact of delays on the country’s energy stability.

Impact on South Africa’s energy strategy

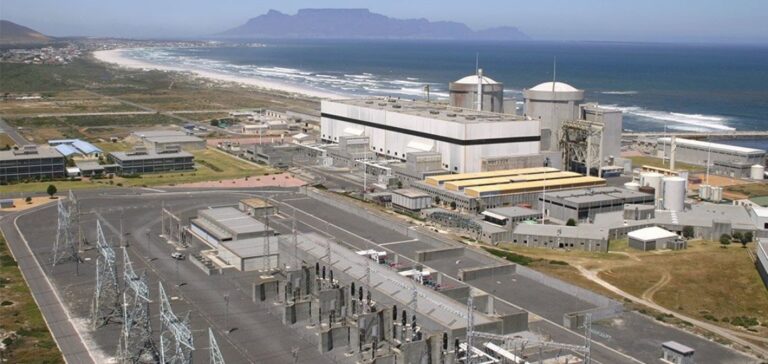

South Africa, as the only African nation with an operational nuclear power plant, is at a critical crossroads in its energy policy.

The 20-year life extension of the Koeberg plant confirms the importance of nuclear power in the country’s energy mix, despite public reluctance and legal challenges.

The government, while proceeding cautiously, continues to regard nuclear power as an essential pillar of its strategy to guarantee a stable and diversified supply.

Ongoing consultations aim to consolidate this approach, while ensuring that the regulatory framework and procurement processes are aligned with international best practice.

The postponement of the project also reflects the need for the government to gain the trust of stakeholders, particularly in a sector where past mistakes have left lasting traces.

The emphasis on transparency and public participation marks a change in tone, but time is running out for the country to meet its energy targets while navigating between legal constraints and decarbonization imperatives.