The Russian Federation is working on the design of gas turbines exceeding the 300 MW threshold, a segment so far absent from its domestic production. This announcement comes from the Ministry of Industry and Trade, which stated that developments will cover several ranges, from 6–8 MW units to models above 300 MW. The program also includes converting a 7 MW turbine into a marine configuration and developing 25 MW mobile units.

A project in a context of domestic capacity expansion

To date, the most powerful domestically produced turbine commissioned in Russia is the GTD-110M, installed at the Udarnaya thermal power plant. This model, with a nominal capacity of 560 MW, was inaugurated in 2024 after a 72-hour maximum load test period. It increased the plant’s capacity from 454 MW to 560 MW, marking a major step in replacing imported equipment.

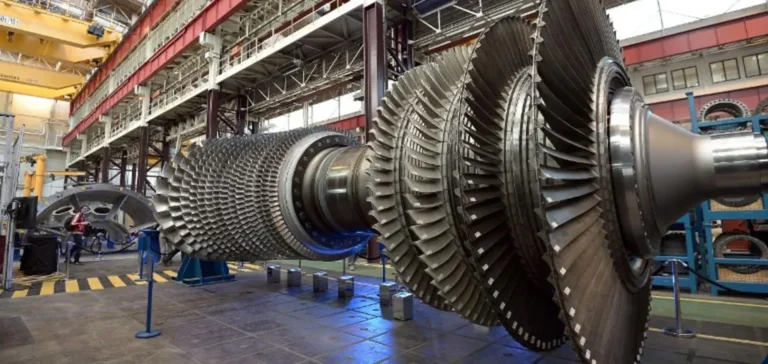

High-capacity gas turbines used in Russia have historically come from foreign manufacturers such as Siemens, General Electric, or Alstom. According to sector studies, more than 60% of turbines over 170 MW in service in the country are imported. Developing a domestic model above 300 MW is therefore intended to reduce this technological dependence.

Comparison with the most powerful international models

On the global market, single-cycle power records are currently held by Mitsubishi Power’s M701JAC (≈ 574 MW, combined-cycle efficiency: 64%), closely followed by GE Vernova’s 9HA.02 (571 MW, 64%) and Siemens Energy’s SGT5-9000HL (545 MW, 63%). The Italo-Chinese Ansaldo/Shanghai Electric GT36 reaches 538 MW with an efficiency close to 63%.

In combined-cycle operation, these models exceed 850 MW installed, with efficiencies above 63%. The Russian GTD-110M, with its 560 MW, falls within the same power range as the global leaders in single-cycle mode but remains behind in terms of maximum efficiencies achieved by H- and J-class turbines.

Industrial prospects and sector implications

Developing a domestic turbine above 300 MW requires the creation of specialized testing facilities, particularly for high-voltage electrical equipment and gas-insulated circuit breakers. A dedicated testing center is being prepared to enable full validation of equipment within Russian territory, an infrastructure rare on a global scale.

For industrial players, the success of this program will determine the country’s ability to compete directly with international manufacturers in the strategic segment of high-capacity gas turbines. Current data suggest a market where domestic supply could eventually meet all internal needs and target certain regional export markets.