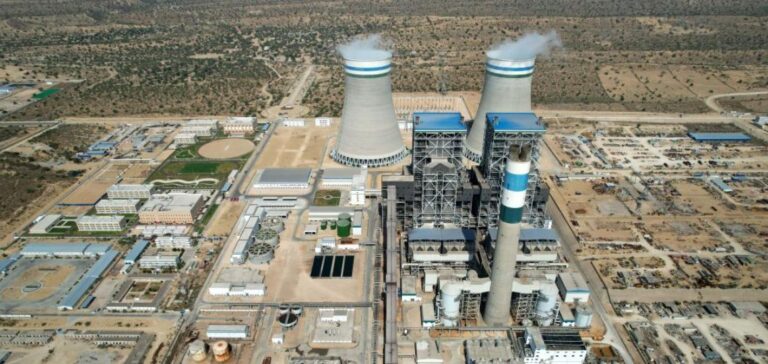

Pakistan is making a strategic shift in its energy sector by encouraging Chinese power plants on its territory to switch from imported coal to domestic coal from the Thar region. This measure is part of a wider plan of reforms supported by the International Monetary Fund (IMF ) to reduce the country’s energy debt. Awais Leghari, Head of the Power Division of the Ministry of Energy, said that this transition could significantly reduce energy costs and ease the pressure on Islamabad’s foreign exchange reserves. In fact, switching to local coal would reduce annual coal imports by over 200 billion Pakistani rupees (around $700 million), resulting in a 2.5 Pakistani rupee per unit reduction in the price of electricity.

Economic and financial issues

This transition to Thar coal is also seen as a solution to facilitate the repatriation of dividends for Chinese power plants, thus offering a better return on investment in dollars. It comes as Pakistan seeks to restructure its energy debt and meet the demands of the IMF as part of a $7 billion rescue package. Last April, a subsidiary of the Engro conglomerate, Engro Corporation Ltd, sold its thermal assets, including Pakistan’s leading coal production company, Sindh Engro Coal Mining, to Liberty Power. The decision was prompted by Pakistan’s foreign currency crisis and the potential of indigenous coal reserves.

Reforms and structural challenges

Pakistan’s energy sector faces major challenges, including high rates of electricity theft and distribution losses, which have led to an accumulation of debt. The government is committed to implementing structural reforms aimed at reducing this “circular debt” by 100 billion Pakistani rupees a year. Poor and middle-class households have been particularly hard hit by electricity rate hikes, imposed as part of a previous IMF financing program. Annual electricity consumption in Pakistan is set to fall for the first time in 16 years due to rising tariffs, despite record summer temperatures.

Transition to alternative energies

Leghari also pointed to a growing trend among urban and rural households to turn to alternatives such as solar power, due to high electricity tariffs. Currently, around 1,000 megawatts are connected to the grid in the form of net metering and other systems, with conservative estimates suggesting that solar capacity could be five to six times higher. This transition to local coal and renewable energies represents a crucial step in Pakistan’s energy strategy, aimed at stabilizing the economy while addressing environmental and social challenges. In short, Pakistan’s plan to promote the use of Thar coal by Chinese power plants could not only reduce the sector’s energy costs and debt, but also encourage a transition to more sustainable and locally available energy sources.