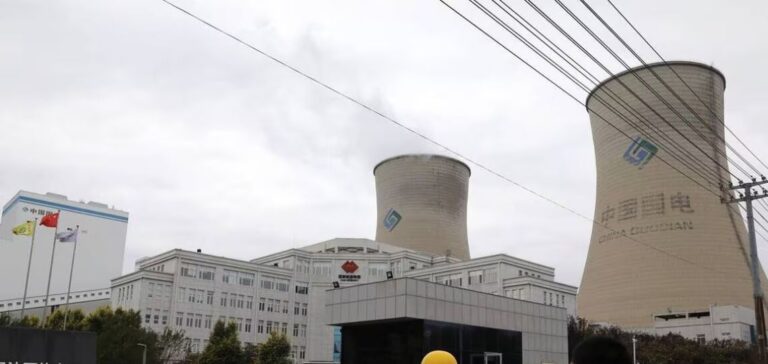

China, the world’s leading coal consumer, is stepping up its efforts to integrate green ammonia into its coal-fired power plants.

This initiative aims to reduce CO₂ emissions, an urgent necessity in the face of today’s climate challenges.

The use of green ammonia as an alternative fuel represents a significant step forward in the decarbonization of traditional energy sources.

Development of green ammonia projects

According to data from S&P Global Commodity Insights, 26 green ammonia projects are planned in China between now and 2026, with a total annual capacity of 4.3 million tonnes.

These projects are concentrated mainly in Inner Mongolia and the north-east of the country.

China’s National Development and Reform Commission (NDRC) is proposing a fuel mix including more than 10% biomass and green ammonia, aimed at reducing the carbon intensity of coal-fired power plants by 20% by 2025 and 50% by 2027 compared with 2023 levels.

The ambitious target of halving emissions requires an annual capacity of 200 million tonnes of green ammonia if China imposes a 10% replacement of coal in all its current power plants.

However, the carbon capture and storage (CCS) option could help achieve this target at lower cost, according to Anri Nakamura, Senior Analyst at Commodity Insights.

Challenges and prospects for the green ammonia market

Despite these advances, the high cost of green ammonia compared with coal remains a major challenge.

Nakamura points out that the price of ammonia could discourage producers from remaining in the domestic market without significant government subsidies.

Subsidizing the fertilizer industry to stimulate green ammonia production could be a more cost-effective solution for the government.

Yu Han, Director of Coal Transition at Energy Foundation China, sees the NDRC’s announcement as a crucial first step towards coal’s energy transition.

However, the use of green ammonia is likely to be limited to regions with high wind and solar reduction potential, as current policy prioritizes innovation and improvement of low-emission technologies rather than a mandatory fuel mix.

Export ambitions

Despite initiatives to promote green ammonia in China, producers are turning mainly to export markets.

Domestic demand remains uncertain, not least because of the additional costs for farmers and possible repercussions on food prices.

On the other hand, markets such as Japan and South Korea are showing increased interest in green ammonia, particularly for co-combustion and clean energy projects.

Japan plans to use 3 million tonnes of ammonia by 2030, with co-combustion tests already underway.

South Korea has launched an auction to trade electricity generated from clean hydrogen and its derivatives, including ammonia.

Platts, a division of Commodity Insights, valued the price of low-carbon ammonia for Japan and Korea at $470/mt CFR on July 23.

The integration of green ammonia into China’s coal-fired power plant decarbonization strategies represents a major shift towards cleaner energy.

Growing international demand for sustainable energy solutions could open up new opportunities for Chinese producers, strengthening their position in the global market.