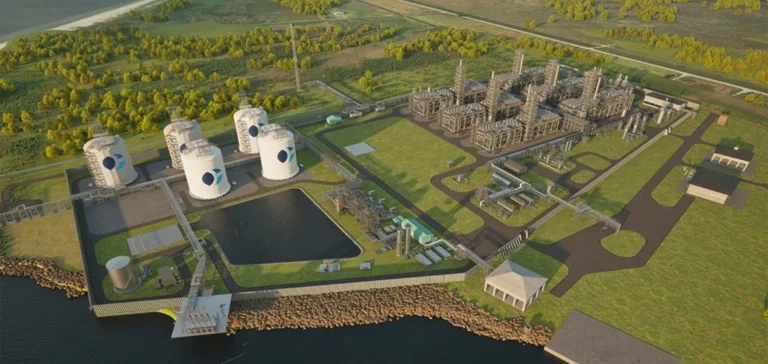

Commonwealth LNG has announced the award of an engineering, procurement and construction (EPC) contract to Technip Energies for the development of its liquefied natural gas (LNG) terminal with a capacity of 9.5 mn tonnes per year in Louisiana. This project, located in Cameron Parish, stands among the major new developments in the liquefied natural gas sector in the United States.

A key contract for the liquefied natural gas market

Technip Energies, recognised for its expertise in modular design and delivery of LNG projects, has already participated in the basic engineering phase of this terminal. The company has also contributed to optimising the construction schedule, costs and procurement strategy for the entire project. According to Commonwealth LNG officials, the collaboration aims to ensure delivery of the terminal on time and within the agreed budget.

The EPC contract incorporates a modular approach to construction, distinct from traditional methods commonly used in the United States. This strategy is expected to accelerate commissioning while enhancing cost predictability for investors and financial partners. Preparatory work carried out by Technip Energies during the initial phase formed the basis for the award of this contract, which also includes a limited notice to proceed for specific initial works.

Industrial perspectives and ambitions

The management of Commonwealth LNG has stated that production of liquefied natural gas at the Louisiana site is scheduled to begin in 2029, subject to a final investment decision expected in the second half of 2025. The project forms part of the global expansion strategy for liquefied natural gas, driven by rising demand for reliable and efficient infrastructure in this sector. Technip Energies has already contributed to the delivery of more than 20% of the world’s operational LNG capacity, thus strengthening its position in this market.

The adoption of the modular approach on this site is presented by the management of both companies as a lever to optimise industrial performance and provide additional assurances on the control of operational risks. The development of the Commonwealth LNG terminal is considered by its promoters as a significant milestone for the American liquefied natural gas industry, both in terms of exported volumes and the modernisation of construction processes.

Economic stakes and local development

The terminal’s capacity of 9.5 mn tonnes per year is expected to support US exports to several international markets, while generating direct economic benefits for the Louisiana region. Project leaders also highlight value creation for the local economy and job opportunities generated by the construction and operation of the terminal.

The international liquefied natural gas market continues to evolve rapidly, driven by the need to strengthen global energy security and diversify supply sources. Technip Energies’ involvement in this project is part of a dynamic sector transformation, where technical innovation and rigorous management of major projects remain key criteria for industrial players.