Coal, particularly in Asia, is far from being an energy of the past. The International Energy Agency is even predicting record consumption in 2021. Driven by Asian demand, this resurgence could nevertheless complicate climate efforts. A look back at the IEA’s Global Energy Review 2021, published earlier this week.

Coal in Asia: lower consumption until 2020

According to the

Global Energy Review

coal is set to make its comeback in 2021. Yet between 2014 and 2019, global coal consumption had fallen by almost 3%. The Covid-19 pandemic has only exacerbated this decline, leading to a collapse of around 4% by 2020.

Coal’s decline is particularly pronounced in Europe, with annual capacity falling by 12%. This is due to the competitiveness of renewable energies and the sharp rise in carbon prices. The United States is also experiencing an irreversible decline in coal production (-23% since 2017). Despite Trump’s election, coal has indeed been unable to withstand the competitiveness of natural gas.

A market now focused on Asia

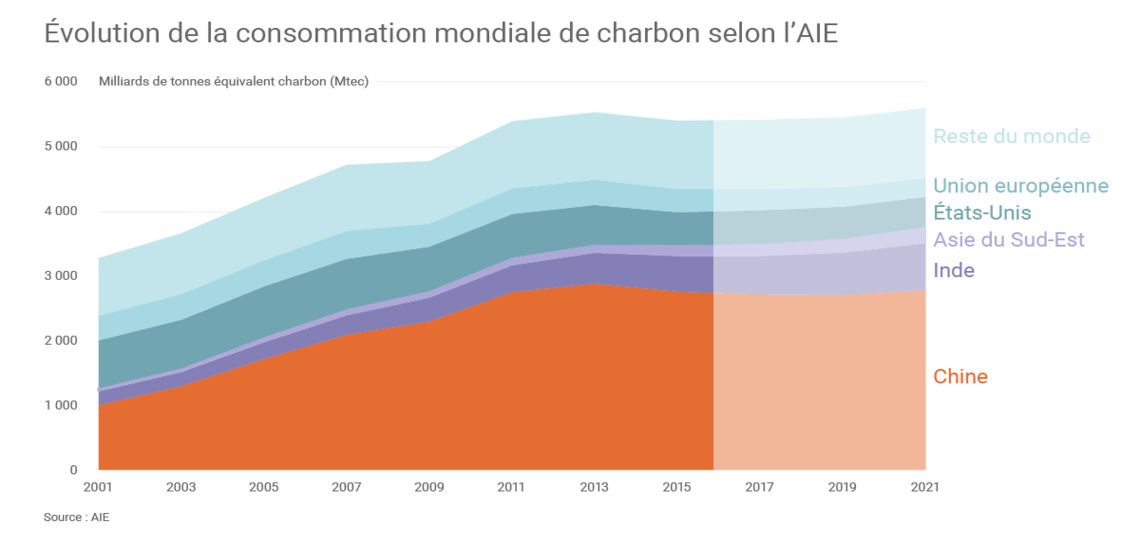

The slump in Europe and the USA has been partly offset by rising demand in Asia. 20 years ago, these two regions accounted for as much of Asia’s coal consumption as China and India. Today, these two countries alone account for two-thirds of global consumption. Globally, 75% of consumption takes place in the Asia-Pacific region.

Nevertheless, while coal demand in Asia is increasing, it has tended to decelerate since 2014. This was mainly due to the Chinese slowdown caused by lower energy growth in recent years. Beijing has also encouraged the closure of coal-fired power plants to improve air quality in major cities.

A very sharp increase in demand in 2021

According to the Global Energy Review, the downward trend underway since 2014 is set to end in 2021. Indeed, the International Energy Agency estimates a 4.5% rise in demand this year. Initially, however, theIEA was forecasting an increase of “only” 2.6% this year. In the end, this will be the strongest growth in consumption, at levels close to the record set in 2014.

It’s important to bear in mind that this growth will affect Asia as much as Europe or the United States. In the latter two regions, gas prices are set to rise sharply as the economy recovers. Coal will benefit from the rebound in industrial production, mainly in the United States and Germany.

Demand continues to grow in Asia

But it is above all coal in Asia that will drive growth in global consumption in 2021. TheIEA thus expects a very strong economic recovery in China, boosting electricity demand and industrial production. Production of steel, cement and other steel products should boost demand for coal. According to the Agency, demand should jump by 4% this year, reaching its highest level ever.

India will also be one of the main drivers of coal consumption, which already accounts for 10% of global consumption. Demand is expected to grow by 9% this year, taking Indian consumption above its 2019 level. This is due to the expected rebound in economic growth, but also to the decline inhydroelectricity production. On a global level, coal consumption is set to increase in all regions of the world.

A world still a long way from the Paris Agreement targets

According to the Global Energy Review, increased coal consumption will lead to a parallel rise in CO2 emissions. TheIEA estimates this rise in emissions at 4.8%, the second highest ever recorded. With 500 million tonnes of CO2 emitted this year, China will be the main contributor to the rebound in emissions.

Despite the announcement of carbon neutrality by 2060, the country continues to install new coal-fired capacity. By 2020, almost 38 GW had been installed, compared with less than 10 GW that had been decommissioned. In India, the government is planning to install almost 60 GW of coal-fired capacity by 2026. For emerging countries, coal remains indispensable, as the growth of renewable energies cannot meet demand.

An increase incompatible with the Paris Agreement

From the point of view of theParis Agreement, this rise in emissions is particularly worrying. Above all, theIEA report sounds like a wake-up call ahead of President Biden’s climate summit. According to the Secretary-General of the United Nations, it would be urgent to eliminate coal as early as 2040 in order to meet the 2°C target.

However, the youth of Asia’s coal fleet makes it very difficult to achieve this objective. A power plant has a lifespan of between 25 and 40 years. What’s more, Asia cannot benefit from abundant gas reserves, making coal the energy that complements renewable energies. For example, coal-fired power plants are often used as reserve capacity to make up for the intermittency of renewable energies.

As a result, the Global Energy Review reiterates the indispensable role of coal in Asia’s energy mix. Unlike in Europe and the United States, coal remains competitive with gas and renewable energies in this region. The next climate summit will therefore have to focus on ways of eliminating coal by 2040. Without results in this area, it will be impossible to meet the objectives of the Paris Agreement.