China has strongly rejected statements by US President Donald Trump urging an end to its imports of Russian oil, stating that it will continue its normal energy cooperation with the Russian Federation. The Chinese Ministry of Foreign Affairs declared that these imports fall under legitimate international trade and condemned American pressure as a violation of global economic rules.

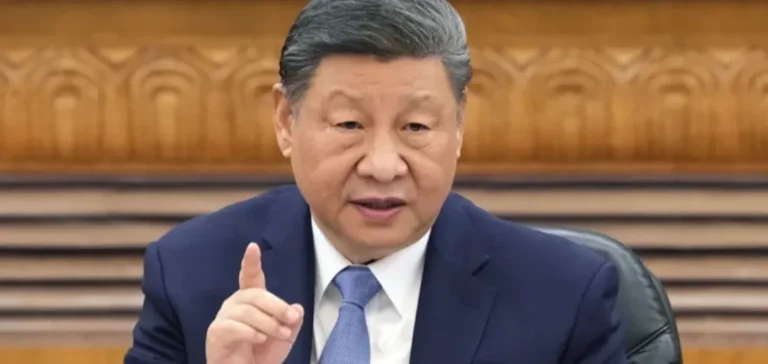

“The actions of the United States are a typical example of unilateral bullying and economic coercion,” said Ministry spokesperson Lin Jian during a press briefing. He added that China firmly opposes any extraterritorial measures aimed at obstructing its trade relations with foreign partners. The statement follows Trump’s claims of securing a commitment from India to stop buying Russian oil and his intention to place similar pressure on China.

Washington increases efforts to isolate Russian oil flows

The United States is stepping up its strategy to deter Moscow’s energy partners through tariff and regulatory tools. Economic sanctions and customs duties aim to reduce Russia’s oil revenues, its main source of state funding. Expanding this strategy to China signals a broader approach by the US, despite China’s position as the world’s second-largest economy.

Oil trade between China and Russia has accelerated in recent months. According to official Chinese data, imports of Russian crude exceeded 2 mn barrels per day in the first half of the year. This commercial trend reflects a shift in global energy flows, partly bypassing circuits dominated by Western companies.

Strategic interests seen as incompatible by Beijing

The Chinese government maintains that its energy procurement policy is solely determined by national interests and rejects any foreign interference. Lin Jian reiterated China’s opposition to using trade as a political instrument, especially when such measures impose unilateral choices. Energy ties with Russia are considered a key pillar of China’s resource security strategy.

No announcements have been made regarding a potential reduction in oil volumes purchased from Russia. Maintaining these flows is seen in Beijing as a response to Washington’s attempt to link energy policy with strategic alliances. The dispute highlights a growing conflict of interest between the two powers on the global energy stage.