ADNOC and Petronas will jointly explore joint resource exploration, development and production opportunities in Abu Dhabi.

Petrones announced in November 2020 its commitment to achieving carbon neutrality by 2050.

ADNOC, for its part, is looking to invest in the Asian new energies markets.

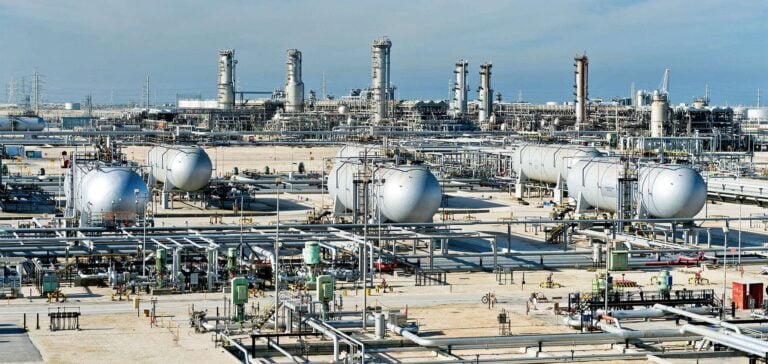

ADNOC and Petronas sign groundbreaking agreement

A cooperation agreement in various sectors

ADNOC (Abu Dhabi National Oil Company) has signed an agreement with Malaysia’s Petronas.

This is an agreement for cooperation in Abu Dhabi’s oil and gas sector.

ADNOC and Petronas will jointly explore opportunities for collaboration in resource exploration, development and production.

The agreement extends to potential cooperation in research and development (R&D).

In particular, it covers technological issues in the field of carbon capture and storage.

The two companies are also cooperating in the bunkering of LNG-carrying vessels at ports in the United Arab Emirates (UAE).

ADNOC and Petronas have also agreed to explore partnership opportunities in the field of trade.

This includes optimizing the supply of crude oil and raw materials, and the purchase of refined products.

United Arab Emirates – Malaysia relations

Discussions between the parties began following the King of Malaysia’s special five-day visit to the UAE last December.

He had been invited by the Crown Prince of the Emirate of Abu Dhabi, Sheikh Mohamed Zayed Al Nahyan.

This partnership marks a milestone in bilateral relations between Malaysia and the UAE.

For both countries, it represents an opportunity to deepen the relationship through strategic energy cooperation.

But this partnership is also in line with the strategies of both companies.

Petronas’ strategy to achieve carbon neutrality by 2050

Petronas is a major LNG exporter, producing around 1.8 million b/d of oil equivalent.

It operates a refining capacity of around 400,000 b/d.

In November 2020, Petronas announced its commitment to achieving zero net carbon emissions by 2050.

The partnership agreement is part of this strategy.

Indeed, the partnership will also explore opportunities for joint production ofgreen hydrogen.

Petronas is preparing to commercialize low-carbon hydrogen produced from its existing facilities, and is pursuing the commercial production of green hydrogen in the near future.

ADNOC turns to Asian new energy markets

ADNOC operates a refining capacity of over 900,000 b/d in Abu Dhabi and manages the world’s fourth largest refinery complex, Ruwais East and West.

The partnership with Petronas is also in line with ADNOC’s strategy of pivoting towards Asia.

This is the continent that consumes most of ADNOC’s oil.

ADNOC has signed a number ofhydrogen agreements for Asian markets.

A hydrogen partnership with a South Korean company is under discussion, as is closer cooperation between South Korea and the UAE.

Also with the Japanese government on the subject of ammonia fuel.

Deepening energy cooperation with the United Arab Emirates

All in all, this agreement undeniably brings the United Arab Emirates and Malaysia closer together.

Nevertheless, it is also in line with the strategies of the two companies in question, namely carbon neutrality for Petronas, and the pivot to Asia for ADNOC.