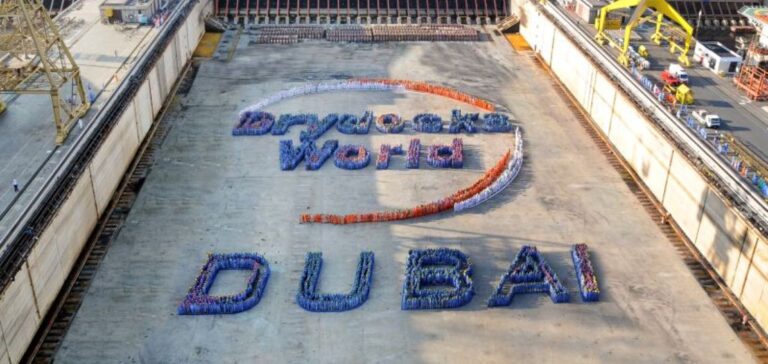

The Baobab MV10 oil platform, located off the Ivorian coast, is set to enter a new operational phase following a temporary shutdown for maintenance announced in late January. On Monday 24 March, Drydocks World, a Dubai-based company specialising in maritime and offshore services, confirmed it had won the contract to refurbish and extend the lifespan of this critical infrastructure.

The Baobab oil field, which has already delivered a significant share of its resources, will see its capacity extended by an additional 15 years through a structured rehabilitation programme. The planned works include the replacement of 1,000 tonnes of steel, coating of 250,000 square metres of tanks, and installation of 11,500 metres of new pipelines. These measures aim to ensure the technical and operational longevity of the floating production, storage and offloading unit (FPSO).

Accelerated schedule for operations resumption

According to Drydocks World, the project will also involve improving living quarters for the crew and integrating advanced technologies to enhance the FPSO’s reliability. This optimisation programme, led by Vaalco Energy, one of the companies operating the site, is scheduled to begin in May. Operations will follow an expedited eight-month timeline, with the objective of resuming production promptly. No financial details regarding the contract have been disclosed.

With a processing capacity of 70,000 barrels of crude oil and 75 million cubic feet of gas per day, the MV10 platform remains a strategic asset in Côte d’Ivoire’s energy supply. The extension of its production phase is expected to bolster the country’s energy output and its regional export capacity.

Context of oil infrastructure expansion

The African Development Bank (AfDB) projects Côte d’Ivoire’s real GDP growth to average 7% over 2024-2025. This growth is partly driven by investments in energy infrastructure, including the Baobab and Baleine oil fields. The development of these facilities is part of a broader national strategy to expand oil sector capabilities.