Vision Lithium Inc. has announced the discovery of a new corridor of lithium-cesium-tantalum (LCT) pegmatites on its Sirmac property in northern Quebec, near the Moblan deposit. Three distinct dykes, each showing significant grades, have been identified across a distance of more than five kilometres, thus establishing the new “Assinica LCT Trend”.

Sampling results from the main dykes

The SC dyke is one of the main structures analysed by the Vision Lithium team. This vein, traced for at least forty metres south of the property boundary, produced samples with results of up to 2.18% Li2O, 1.89% Cs2O and 398 parts per million (ppm) of tantalum (Ta). Six continuous channel samples, measuring between 0.5 and 8.3 metres, were collected despite significant overburden cover.

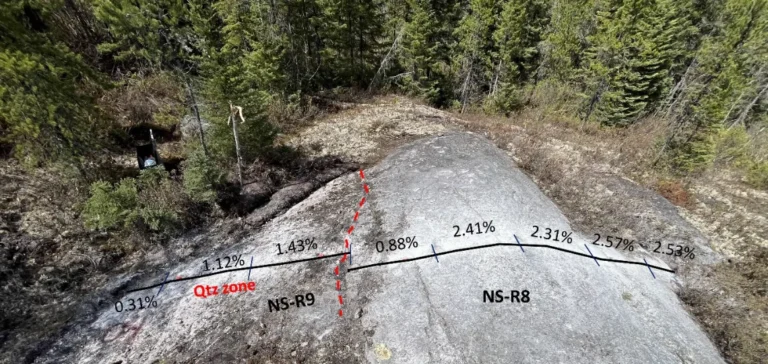

A second dyke, identified 1.2 kilometres west of the SC dyke, extends the discovery made last year by Vision Lithium. The results show grades reaching 1.76% Li2O and 1.98% Cs2O over 7.2 metres as well as 594 ppm of tantalum. Several grab samples, collected to the south and north of the main outcrop, confirm the persistence and extension of mineralisation over several hundred metres.

Third dyke discovery and sector potential

A third dyke, located nearly four kilometres west of the Central Dike, has been identified despite limited exposure. Rock analyses indicate grades up to 2.81% Li2O, 1.02% Cs2O and 470 ppm of tantalum, illustrating the diversity of concentrations in the explored zone. The studied sector is characterised by low relief and large areas covered by overburden, suggesting the presence of further pegmatites at shallow depth.

The exploration programme, coordinated with Innovexplo from Val d’Or, enabled recognition of the mineralised corridor. The team notes that the geological similarity between the different dykes and the recurring high grades reinforce the interest for development of this property. Data from the ongoing campaign will serve to plan further prospecting, geophysical surveys and targeted drilling in the sector.

Outlook for the critical minerals industry

The series of discoveries made on the Sirmac property confirms the emergence of the region as a major hub for lithium, cesium and tantalum exploration. The initial results reinforce the hypothesis of a large-scale mineralised corridor, which could play an important role in the supply of strategic metals. Vision Lithium plans to intensify exploration efforts to further refine understanding of the project’s potential.

Yves Rougerie, President and Chief Executive Officer of Vision Lithium, stated: “The new discoveries suggest the existence of a major trend of LCT dykes rich in lithium, cesium and tantalum, likely to include new regional occurrences.”