Energy research firm Wood Mackenzie reports a surge in next-generation geothermal technologies, now ranked fifth in its annual technology leaderboard. This rise follows a growth in announced projects and notable progress in financing and regulation. These systems could double per-well output compared to conventional geothermal technologies, according to the firm.

A technological breakthrough driven by digital demand

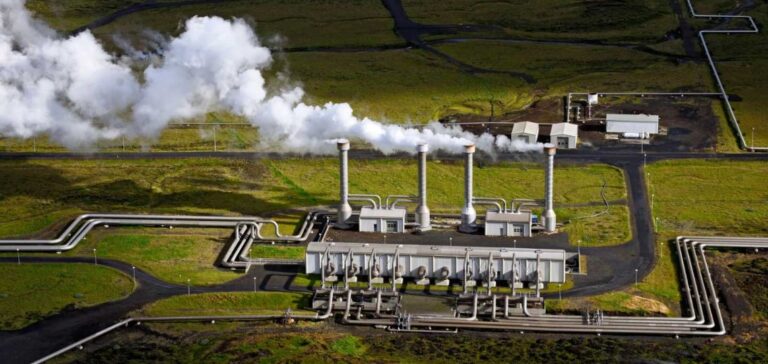

Enhanced Geothermal Systems (EGS) and Advanced Geothermal Systems (AGS) are among the most promising technologies. EGS increases permeability in hot, dry rock, while AGS uses closed-loop systems to repurpose end-of-life oil and gas wells. Their potential for low-carbon baseload generation is attracting increased attention from the digital sector.

Technology companies such as Meta Platforms Inc., Microsoft Corp., and Google LLC have signed significant geothermal power supply agreements. This demand aims to provide consistent, clean, and localised energy to their data centres. Wood Mackenzie notes that this trend reflects a structural shift in global energy demand.

Investment costs remain a constraint

Despite these prospects, high drilling costs present a major barrier. According to Wood Mackenzie, capital expenditures for geothermal projects need to fall by up to 60% to compete with nuclear power in the clean baseload market. Strategies such as co-locating with other low-emission technologies or extracting critical minerals from geothermal fluids are being explored to improve project economics.

Pilot lithium extraction sites are underway in Germany, New Zealand, North America, and the United Kingdom. This convergence between energy production and mining is also drawing interest from governments, several of which are increasing financial support for the sector. In 2024, more than $2bn was allocated to geothermal initiatives, although the majority remains focused on conventional projects.

Political support advancing at a slow pace

Recent legislative changes in some European countries, such as Germany, suggest a more favourable environment for geothermal deployment. However, Wood Mackenzie highlights that capital allocation by major oil companies remains limited. Although BP PLC, Equinor ASA, and Chevron Corp. have signed partnerships with project developers, low-carbon activities still receive marginal priority in their investment portfolios.

“While strategic interest in geothermal is real, progress could be slowed by a lower prioritisation of low-carbon investments,” Wood Mackenzie stated in its report.