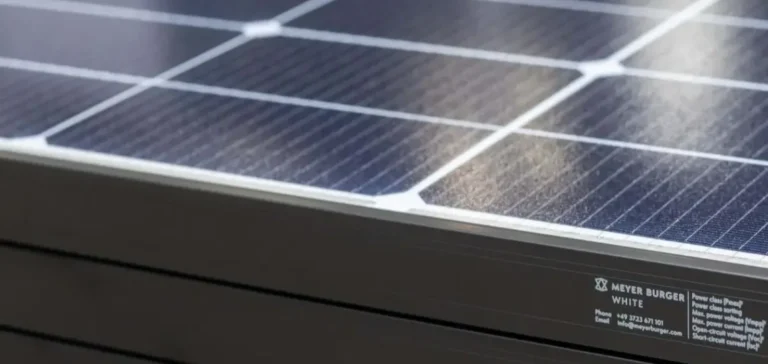

Swiss group Meyer Burger has announced it no longer sees “any realistic chance” of maintaining its operations, after months of unsuccessful negotiations with potential partners. The company, active in the production of solar modules, has been under intense pressure for several quarters due to low-cost imports from China and regulatory volatility in key markets.

Accelerated industrial retreat in Europe and the United States

In Germany, Meyer Burger initiated insolvency proceedings for two of its industrial sites: the solar cell plant in Thalheim in August, followed by the Hohenstein-Ernstthal site in September. In the United States, the group had already begun proceedings under Chapter 11 of US bankruptcy law in June. These decisions follow a gradual withdrawal plan, confirmed by a wave of layoffs affecting around 600 people in Germany and 300 more in the United States as early as May.

Disappointed hopes after rapid expansion

Initially focused on manufacturing equipment for slicing silicon wafers for the semiconductor industry, Meyer Burger shifted toward the solar sector by becoming a module producer itself. Two factories were opened in Germany in 2021 as part of a strategic repositioning. However, the rapid rise of low-cost Chinese production quickly eroded the group’s margins in the European market.

A failed American attempt

Hoping to offset its European losses, the company bet on expansion in the United States, where federal investment programmes in renewable energy seemed to offer higher profitability. But in November, it lost its main US client, triggering a significant drop in its market capitalisation. The American strategy, despite support from the Inflation Reduction Act subsidies, failed to reverse the group’s downward trajectory.

Progressive liquidation and delisting

In Switzerland, the group still benefits from provisional debt-restructuring protection, avoiding immediate bankruptcy. Nevertheless, the remaining 45 employees have received notice, confirming the ongoing liquidation process. Last week, the Swiss stock exchange operator announced the delisting of Meyer Burger shares, sealing the company’s exit as a listed player.