Google, through its research division Alphabet Inc, announced an equity investment and a global strategic partnership with Energy Dome, an Italian company specialising in long-duration energy storage (LDES). This initiative directly involves Oman, where the government is already supporting the technology through the sovereign wealth fund Oman Investment Authority (OIA).

A CO₂-based storage technology

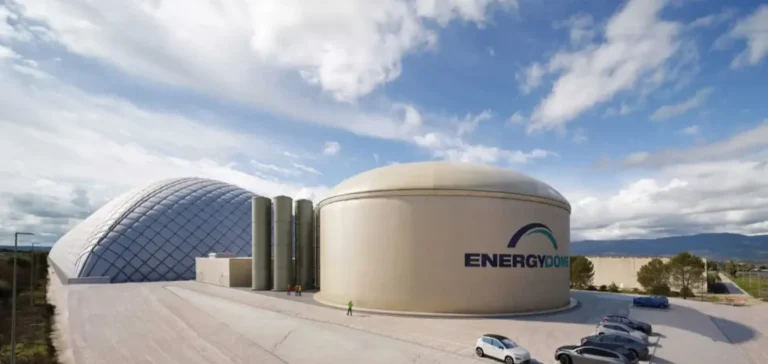

The system developed by Energy Dome relies on the use of carbon dioxide (CO₂) stored within a dome-shaped structure. During periods of surplus renewable energy production, CO₂ is compressed and liquefied using excess electricity. When electricity demand increases, the liquid is vaporised into a hot, pressurised gas, driving a turbine that feeds zero-emission power into the grid for durations ranging from eight to twenty-four hours.

Through its venture capital arm, IDO Investments, OIA participated in a funding round for Energy Dome three years ago. A memorandum of understanding signed between OIA and Energy Dome also led to the creation of Takhzeen Oman, a local partner responsible for deploying the technology in the country.

Towards a first large-scale project

According to Takhzeen Oman, this partnership with Google could accelerate the implementation of a high-capacity storage project in Oman, combined with a solar power plant. Electricity generated by the plant would charge the CO₂ battery system during the day and be released at night or during peak demand hours.

Energy Dome will supply the complete storage facility, while Takhzeen Oman will handle its installation, operation and maintenance over a thirty-year period. The green electricity generated will be sold to a designated buyer under a purchase agreement.

Eng Nawaf al Balushi, Managing Director of Takhzeen Oman, stated that this collaboration represents “a major global milestone” for the technology, and that it could “support greater integration of renewable energy into the power grid.”