At almost the same time as Ecuador announced this week that it would halt oil production at an iconic field in the Amazon, Brazil was boasting of massive hydrocarbon investments, with plans to explore for oil near the mouth of the Amazon.

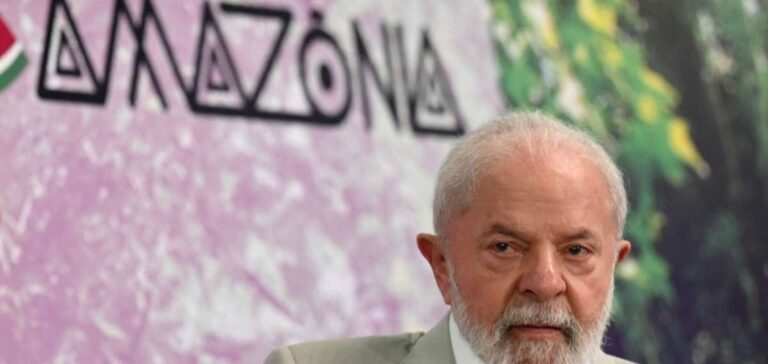

Brazil’s oil paradox: Lula and the environmental challenges of energy pressure

A paradox for the government of left-wing President Luiz Inacio Lula da Silva, which likes to present itself as a champion of the fight against climate change, but has been criticized for its reluctance to abandon fossil fuels.

“We hope that the Brazilian government will follow Ecuador’s example,” said Marcio Astrini, of the NGO group Observatoire du climat, in a statement.

This strategic issue was also discussed at a summit of Amazonian countries two weeks ago, in the Brazilian city of Belem, but Lula turned a deaf ear when his Colombian counterpart Gustavo Petro called for a halt to all oil exploration in the region. On the contrary, a few hours after the announcement on Monday of the result of the “historic” referendum in Ecuador to preserve the Yasuni reserve, the presidency of Brazil, home to 60% of the Amazon rainforest, announced a 335 billion reais (around 64 billion euros) investment plan in the hydrocarbons sector. The plan calls for state-owned oil company Petrobras to explore an offshore deposit, block “FZA-M-59”, located not far from the estuary where the Amazon River flows into the Atlantic.

This project has exposed differences within the Lula government. The Ibama environmental protection agency refused to grant Petrobras an exploration license on the grounds that the company had not submitted the necessary studies. But on Tuesday, the Union’s General Counsel’s office, which defends the government’s interests, issued a favorable opinion on the project, considering that the studies were “not indispensable”. Environment Minister Marina Silva, for her part, strongly called for compliance with the “technical” criteria imposed by Ibama.

Black gold “dream” in the Amazon: the Brazilian administration’s oil exploration on the Guyana line despite Amazon fragility

Returning to power in January after ruling from 2003 to 2010, 77-year-old Lula pledged to make preserving the Amazon a priority, following a surge in deforestation under the presidency of his far-right predecessor Jair Bolsonaro. But the former lathe-mill operator recently declared that the people of northern Brazil could “continue to dream” of black gold, despite Ibama’s objections.

Guyana, a small Amazonian country on Brazil’s northern border, has extracted an enormous amount from neighboring waters since 2019, to the point of being dubbed “the Dubai of South America”. The “FZA-M-59” exploration project has drawn fierce criticism from environmental organizations, indigenous leaders and the inhabitants of Marajo, an island in the heart of the Amazon river mouth. Critics cite the risk of catastrophic impact on this mangrove region with its fragile biodiversity.

“The majority of the planet is suffering the consequences of some people turning nature into a source of profit,” says Naraguassu, a 60-year-old activist from the Caruana indigenous people, who hold sacred the site where the Amazon meets the Atlantic. “Temperatures keep rising, the Earth is telling us something is wrong,” she tells AFP.

For Luis Barbosa, of the Marajo Observatory, a local NGO, it is the “very existence” of his island that is threatened by rising water levels, linked among other things, according to him, “to the continued use of fossil fuels”.

At the crossroads of energy: Oil exploration in the Amazon to launch a “sustainable energy transition

Petrobras, for its part, believes that this project “will open up a new energy frontier”, with a view to a “sustainable energy transition”. The company points out that the “FZA-M-59” block is more than 500 kilometers from the mouth of the Amazon, and promises a “robust” protocol to contain any leaks. But Brazil, the world’s eighth-largest oil producer, is already self-sufficient in this hydrocarbon, explains Climate Observatory specialist Suely Araujo, who headed Ibama from 2016 to 2019.

“We’re living through a climate crisis, so there’s no reason to persist in wanting to explore for oil in sensitive areas,” she argues.

It was under his leadership that Ibama refused a license to the French group Total to drill five offshore blocks in the same region in 2018. Ms Araujo welcomes the Brazilian president’s ambitions in the fight against climate change, but deplores the fact that he is not ready to abandon fossil fuels. For her, “the great contradiction of the Lula government is oil”.