The global hydrogen fuel cell market is expected to grow from $5.7bn in 2024 to $42.3bn by 2035, with a compound annual growth rate of 20%. This growth is fuelled by the industrialisation of hydrogen technologies, the diversification of applications in transport, industry, and stationary energy, and substantial investments across the value chain.

Multiple applications in strategic sectors

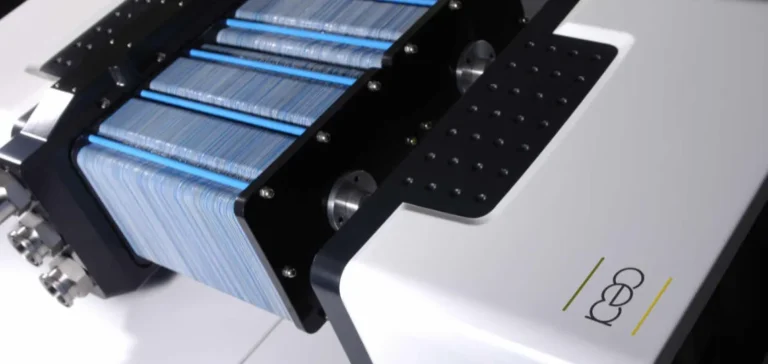

Hydrogen fuel cells generate electricity through an electrochemical reaction between hydrogen and oxygen, with water and heat as the only byproducts. This makes them compatible with carbon neutrality targets set by many industrialised economies. Unlike batteries, fuel cells produce electricity continuously as long as hydrogen is supplied.

Key application areas include transport (passenger vehicles, heavy-duty trucks, maritime and rail), stationary power systems (public grids, microgrids, backup systems), and energy-intensive industrial processes such as steelmaking, cement production, and chemicals. The defence sector is also identified as a deployment channel for hydrogen technologies.

Acceleration enabled by innovation and political support

The market’s rise is notably driven by technological advances in proton exchange membrane (PEM) fuel cells and solid oxide fuel cells (SOFC), which offer improved efficiency and greater durability. The development of so-called green hydrogen, produced from renewable energy, further enhances the appeal of fuel cells in global energy markets.

Public policies are playing a decisive role in this acceleration, through tax incentives, investment subsidies, and national roadmaps aimed at building hydrogen ecosystems. Several governments have designated this technology as strategic for reducing energy dependence and boosting industrial competitiveness.

Convergence of stakeholders around a new energy growth driver

The creation of a viable market relies on coordination between governments, industries, and investors. Many pilot projects are now being replaced by large-scale deployments, supported by public-private partnerships and multi-year investment plans. Hydrogen supply infrastructure, still in early stages, is the focus of fast-tracked development programmes in several regions.

Hydrogen fuel cells are gradually positioning themselves as a transitional technology capable of meeting diverse energy needs, with broad deployment potential. Rapidly changing market conditions and increased capital mobilisation are reinforcing their integration into national energy strategies.