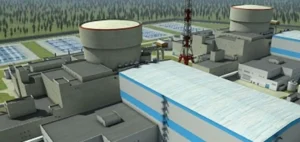

French group Orano, a global specialist in uranium, is escalating its dispute with the State of Niger. The company has officially filed a new request with the International Centre for Settlement of Investment Disputes (ICSID). This intensifying conflict stems from Orano’s loss of control over its Nigerien subsidiary, Somaïr (Société des Mines de l’Aïr), of which it holds 63.4%, with the remainder owned by the State of Niger.

This move comes amidst a tense backdrop. Since the military coup in July 2023, Niger’s regime has intensified measures to assert sovereignty, particularly over strategic resources such as uranium. For Orano, this has resulted in commercial roadblocks and the inability to exercise its removal rights, exacerbating Somaïr’s financial situation.

A commercial and financial deadlock

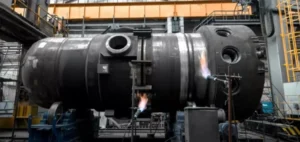

According to Orano, the State of Niger has obstructed the sale of 1,300 tons of uranium concentrate, valued at approximately €250 million. These actions, described by the company as a breach of contractual rights, led to the suspension of production at Somaïr since October 31, 2024. Simultaneously, the French company incurred a €133 million loss in the first half of 2024, primarily due to its Nigerien operations.

Despite multiple attempts to resolve the dispute amicably, Orano asserts that discussions have yielded no results. This latest arbitration process aims to secure damages while asserting the company’s rights over the mining stock in question.

A strategic and legal context

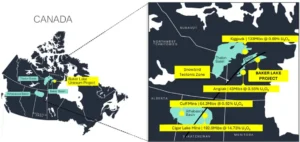

Niger, the fourth-largest uranium producer globally in 2022, represents a key resource for global energy ambitions and European nuclear energy needs. Orano, 90% owned by the French state, relies heavily on this resource for its operations. However, rising political tensions and unilateral decisions by the Nigerien regime highlight the risks of investing in geopolitically unstable regions.

This is not Orano’s first arbitration effort to defend its interests in Niger. In December 2024, the company filed an initial request following the withdrawal of the exploitation permit for the Imouraren site, a deposit with reserves estimated at 200,000 tons of uranium.

The resolution of these disputes could shape the future of the global uranium market and economic relations between France and Niger while underscoring the challenges faced by companies operating in politically sensitive environments.