The US Department of Energy (DOE) announced the opening of applications on October 16 for $900 million in funding intended for the initial domestic deployment of Generation III+ small modular reactors (Gen III+ SMR). This initiative aims to promote the safe and responsible deployment of advanced reactor technologies while supporting follow-on reactor projects aligned with national climate goals.

Allocation of Funds

Under the 2021 federal infrastructure law, the DOE plans to allocate the $900 million in two tiers. The first tier, managed by the Office of Clean Energy Demonstrations, will provide up to $800 million in milestone-based grants. These grants will support up to two pioneering teams consisting of utilities, reactor vendors, constructors, and end users/offtakers committed to deploying a first plant, while facilitating a multi-reactor, next-generation order book. These teams will have the opportunity to collaborate with the National Nuclear Security Administration (NNSA) to incorporate safety and security measures by design in the projects.

The second tier, managed by the Office of Nuclear Energy, will allocate up to $100 million to encourage additional deployments of next-generation SMRs. This funding aims to address gaps hindering the domestic nuclear industry in areas such as design, licensing, supplier development, and site preparation. Second-tier applicants must be planned project owners or entities seeking to improve the capability, competitiveness, or profitability of the domestic supply chain for Gen III+ SMRs.

Objectives and Official Statements

US Secretary of Energy, Jennifer Granholm, stated: “Revitalizing America’s nuclear sector is essential to add more carbon-free energy to the grid and meet the needs of our growing economy—from artificial intelligence and data centers to manufacturing and healthcare.” The DOE estimates that the United States will need approximately 700 GW to 900 GW of additional clean, reliable power capacity to achieve net-zero carbon emissions by 2050.

Under the 2024 Consolidated Appropriations Act, the DOE plans to offer the $900 million in two distinct tiers, as detailed above. Applications for this funding are expected by January 17.

Nuclear Renaissance in the United States

In 2023, nuclear provided nearly half of the United States’ carbon-free electricity. Utilities across the country are considering extending the lifespans of existing reactors, reversing plans to retire reactors, or restarting reactors that were shut down in recent years. The completion of Southern Company’s Alvin W. Vogtle Nuclear Plant expansion earlier this year sparked debate about the future of nuclear energy in the United States, including both large and small-scale reactors.

Ali Zaidi, White House National Climate Advisor, stated: “Across the country, we are witnessing a robust resurgence in American energy innovation—from bringing back previously shuttered nuclear plants to bringing online new technologies and new reactors.” Currently, there are no commercial SMRs providing electricity to the grid in the United States, although several companies and utilities are exploring various designs, capacities, and deployment scenarios.

Applications and Future Perspectives

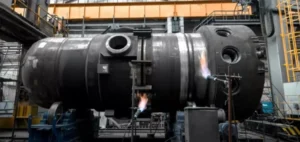

SMRs can be used for power generation, process heat, desalination, and other applications, according to the DOE. These reactors are designed to include more factory-constructed components and to have the ability to match loads and scale to meet different demand needs.

The DOE indicated that Gen III+ SMRs could revitalize and leverage the expertise, workforce, and supply chains supporting the existing fleet of large light-water reactor designs, thus providing a near-term path for new nuclear deployments and operations.

In July, President Joe Biden signed legislation known as the ADVANCE Act to support the development of advanced reactors by reducing Nuclear Regulatory Commission (NRC) licensing times and cutting application review fees required to be paid by the nuclear industry.