The United States installed 2.1 gigawatts (GW) of wind capacity in the first quarter of 2025, marking a dramatic 91% increase over the same period last year. Wood Mackenzie and the American Clean Power Association project 8.1 GW of installations for the whole of 2025, including onshore, offshore and repowering projects. However, this apparent growth conceals major structural challenges that are redefining the US wind industry.

Turbine orders fell by 50% in the first half of 2025 compared to the previous year, reflecting growing concern among developers about the regulatory environment. On January 20, 2025, the Trump administration signed a presidential memorandum withdrawing all Outer Continental Shelf areas from wind leasing and ordered a temporary halt to all new permits for wind projects. This decision provoked an immediate response from 17 states and Washington D.C., which filed a lawsuit against these restrictions.

A regulatory revolution with major economic consequences

The One Big Beautiful Bill Act (OBBBA), enacted on July 4, 2025, fundamentally alters the landscape of tax incentives. Tax credits for wind and solar projects end for installations commissioned after 2027, with a limited exception for projects beginning construction within 12 months of enactment. For other technologies, tax credits remain on the original schedule: after 2032, they are gradually reduced to 100% in 2033, 75% in 2034, 50% in 2035 and reach 0% in 2036 (see OBBBA – One Big Beautiful Bill: Pros & Cons: The Good, Bad, and the Ugly). This accelerated phaseout schedule represents a sharp change from previous deadlines.

New bureaucratic requirements now require Secretary of the Interior Doug Burgum to personally approve each wind project on public lands. This administrative centralisation creates unprecedented bottlenecks in the permitting process. Developers must also navigate a maze of new restrictions regarding “foreign entities of concern” (FEOC), drastically limiting financing and component sourcing options.

The impact of tariffs on sector competitiveness

Proposed tariffs of 25% on imports from Mexico and Canada, and a further 10% on Chinese imports, threaten the economic viability of projects. Wood Mackenzie estimates these measures could increase onshore wind turbine costs by 7% and overall project costs by 5%. The levelised cost of energy (LCOE) could rise by 4% in the short term, reaching 7% in a universal tariff scenario.

The US wind industry relies heavily on imports for critical components such as blades, gearboxes and electrical systems. In 2023, wind equipment imports totalled $1.7bn, with 41% sourced from Mexico, Canada and China. This dependence exposes the sector to major vulnerabilities in the face of protectionist policies.

The reshaping of the competitive landscape

GE Vernova dominated the US onshore market with 56% of installations in 2024, followed by Vestas (40%) and Siemens Gamesa (4%). In the offshore segment, Siemens Gamesa held an even more dominant position with 57% of projects selecting a supplier, compared to 32% for Vestas and 11% for GE Vernova. This market concentration reflects growing barriers to entry in a more complex regulatory environment.

The sector’s five-year outlook has been revised down by 40% compared to earlier projections of 75.8 GW. Wood Mackenzie now forecasts 33 GW of new onshore capacity, 6.6 GW offshore and 5.5 GW of repowering by 2029. This drastic revision illustrates the combined impact of restrictive policies and economic uncertainty on investment decisions.

Technological opportunities amid political challenges

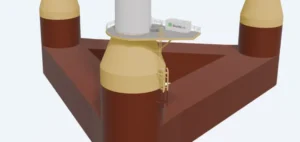

Despite this unfavourable context, some emerging technology segments retain potential. The global floating offshore wind market is expected to grow at a compound annual rate of 31.5% from 2025 to 2034. The US holds 2.8 terawatts of offshore wind potential in waters too deep for conventional technologies, representing two-thirds of the country’s total offshore potential.

Individual states are pursuing ambitious goals despite federal obstacles. New York aims for 9 GW of offshore wind by 2035, while New Jersey targets 11 GW by 2040. These local commitments are creating sustained demand that could partially offset the effects of restrictive federal policies.

The economic impact of these changes will be felt beyond the wind sector. Energy Innovation forecasts rising electricity bills across the United States, with particularly marked increases in Republican states that rely heavily on renewables for their power supply. Developers who secured power purchase agreements before the pandemic now face a fundamental mismatch between fixed revenues and rising costs.

The US wind sector stands at a critical juncture. Record installations in the first quarter of 2025 may represent a final surge before a prolonged slowdown. Developers are accelerating projects to take advantage of the last available tax credits, creating an artificial spike in activity that conceals long-term structural challenges. The industry’s ability to adapt to this new environment will determine whether the United States maintains its position in the global energy transition or yields technological leadership to other nations.