Ukraine has decided not to extend its gas transit contract with Gazprom beyond 2024, marking a turning point for the European energy market.

For decades, Europe has relied on Ukrainian pipelines to receive Russian gas, and this decision, taken in the midst of the war between Russia and Ukraine, upsets the continent’s energy balance.

With around 14 billion cubic meters of Russian gas transiting through Ukraine in 2023, compared with the 40 billion initially forecast, European and Russian players are preparing for major changes.

Consequences for the European gas market

The end of Russian gas transit via Ukraine will have a considerable impact on the European countries that depend on these supplies.

In 2023, Slovakia, Austria and Moldavia respectively imported 3.2, 5.7 and 2 billion cubic meters of gas via Ukraine.

According to S&P Global, the cessation of transit from 2025 onwards will require critical work to optimize the Ukrainian gas network, as Russian gas transit volumes have already fallen considerably short of contracted volumes.

To compensate for these interruptions, Europe needs to diversify its gas supply sources.

Since 2022, efforts have been underway to increase imports of liquefied natural gas (LNG).

Germany, for example, has accelerated the construction of new regasification facilities, with a total capacity of 41.54 million tonnes per year planned by 2026.

These new capacities will partially offset the loss of Russian gas volumes via pipelines.

However, the switch to LNG also entails additional costs for Europe.

The LNG market is subject to price fluctuations, and competition for this gas could increase due to growing demand from Asian countries.

Moreover, regasification capacity could exceed LNG demand in the medium term, raising concerns about the profitability of such investments.

Impact on energy security and European infrastructure

The European Commission has warned that interrupting transit via Ukraine could lead to higher transport costs and further complicate the diversification of energy sources.

Discussions are underway to reinforce infrastructure and optimize alternative supply routes, including the use of new energy corridors such as the vertical gas corridor via Greece and Turkey.

Moldova’s situation is particularly complex.

Although it has already diversified its supplies with gas from Romania and Turkey via the Trans-Balkan Pipeline, the country remains dependent on gas transiting through Ukraine to meet the needs of the breakaway region of Transnistria.

Supply adjustments will be necessary, which could involve additional costs and infrastructure investments.

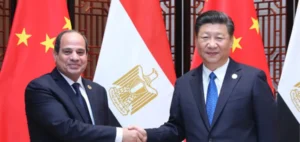

Russian strategy shifts to Asia

Faced with the loss of its European markets, Russia is stepping up its efforts to redirect its gas exports to Asia.

The “Siberian Force” pipeline is at the heart of this new strategy.

Gas exports to China via this pipeline should reach 38 billion cubic meters per year by next year, with a potential increase of a further 10 billion cubic meters via the “Far East” network.

However, diversifying Russian gas exports is no simple matter.

The “Siberian Force 2” project, which could supply more gas to China, will not be completed until 2030, leaving Russia little time to make up for the loss of European revenues.

At the same time, Russia is counting on the development of its LNG sector to increase exports to Asia and other markets.

However, the Russian LNG sector has been hit hard by Western sanctions, delaying key projects such as Arctic LNG 2.

Challenges for European countries and their diversification

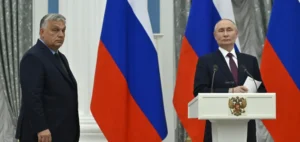

European countries such as Italy and Hungary, which have historically imported Russian gas via Ukraine, also face challenges.

Italy, for example, has already diversified its supplies and developed regasification infrastructures.

However, to compensate for the loss of gas transiting through Ukraine, Italy will have to send around 3.75 billion additional cubic meters to countries such as Slovakia and Austria.

Hungary, on the other hand, could be more exposed to supply shortages, as it still relies heavily on Russian gas flows.

Without increased supplies via the TurkStream pipeline or additional regasification capacity via Italy, Hungary could face significant difficulties in securing its energy needs.

Regional alternatives and Azerbaijan’s uncertain role

As Europe prepares for the end of Russian gas transit via Ukraine, discussions are underway to strengthen energy links with countries such as Azerbaijan.

However, according to Deutsche Welle experts, Azerbaijan’s ability to supply additional gas volumes to Europe is limited in the short term, due to its domestic needs and the absence of new infrastructure to increase exports.

In addition, the possibility of transiting Azerbaijani gas via Russia, Turkey and Moldavia is complicated by high transit costs and complex geopolitical issues.

Increased cooperation between Central and Eastern European countries and regional energy operators will be crucial to securing long-term supplies.

Economic and logistical implications for Ukraine

For Ukraine, the end of Russian gas transit has significant economic implications.

As a major transit corridor, Ukraine benefited from significant gas transport revenues.

With the end of this contract, Kyiv will have to reassess its energy options and adjust its infrastructure to manage its own energy needs.

According to the Carnegie Endowment for International Peace, Ukraine will probably have to import gas via European entry points such as Austria, with additional costs of around 30 to 40 dollars per 1,000 cubic meters.

In 2022, Ukraine has also launched plans to use its gas storage capacities in collaboration with the European Union, hoping to maintain revenues and secure its own energy needs in times of crisis.

Future prospects and global adjustments

The cessation of Russian gas transit via Ukraine is redefining the balance of the European and global energy markets.

Europe faces major challenges in terms of diversification and energy security, while avoiding the exorbitant costs associated with new infrastructures and alternative supplies.

For their part, Russia and its Asian partners need to strengthen their logistics capacities and adapt to increasingly fragmented markets.

Increased collaboration between European and global players, as well as innovation in energy infrastructures, will play a decisive role in navigating this new global energy order.

The geopolitical implications of these adjustments will be felt in the long term, and the strategies deployed today will determine the resilience of tomorrow’s energy systems.