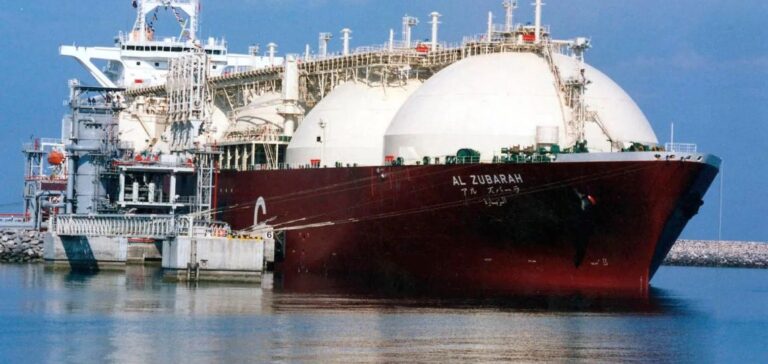

In 2025, the European Union (EU) is turning increasingly towards American liquefied natural gas (LNG) amid escalating trade tensions with the United States. Since Russia’s invasion of Ukraine in 2022, the EU has sought to reduce its reliance on Russian energy, leading to a strategic shift in its gas imports. The share of Russian gas in European imports has dropped from 45% in February 2022 to 13% in 2025.

Increase in imports of American LNG

In response to the reduction of Russian gas imports, the EU has ramped up its purchases of LNG from the United States. This shift is occurring despite ongoing commercial tensions between the two blocs. While the United States, under the Trump administration, has imposed tariffs on certain European products, the EU continues to receive a significant portion of its LNG from the United States. American LNG remains competitive due to its relatively low price, further enhancing the appeal of this market for Europe.

Growing dependence despite geopolitical tensions

This increasing dependence on American LNG occurs even as geopolitical tensions between the United States and the EU intensify. Transatlantic relations have been strained by Washington’s trade policies, notably tariffs on steel and aluminum. However, in the energy sector, gas transactions appear to provide common ground, with European players seeking to secure their supply while diversifying their sources.

Reducing dependence on Russian gas

The EU has reduced its reliance on Russian gas by shutting off Russian pipeline supplies and diversifying its suppliers. This energy reorientation is especially critical in the current context, as Europe seeks to avoid indirectly supporting Russia’s war efforts. The goal is to completely phase out Russian gas by 2027, a target to which the EU is firmly committed.

Geopolitical and commercial implications

The energy relationship between Europe and the United States, although marked by commercial disagreements, seems to be consolidating through gas exchanges. The EU’s energy policy, while remaining committed to its environmental objectives, must take into account the current geopolitical reality. If American LNG exports continue to grow, they could reinforce the EU’s dependence on an external supplier, especially at a time when energy sovereignty has become a key issue.

Environmental challenges related to LNG

Despite the appeal of American LNG, its environmental impact is raising growing concerns. LNG production methods, particularly hydraulic fracturing, are criticized for their environmental effects, especially in terms of methane emissions. While the EU strives to reduce its carbon footprint, increasing reliance on American LNG could jeopardize some of the continent’s long-term climate goals.