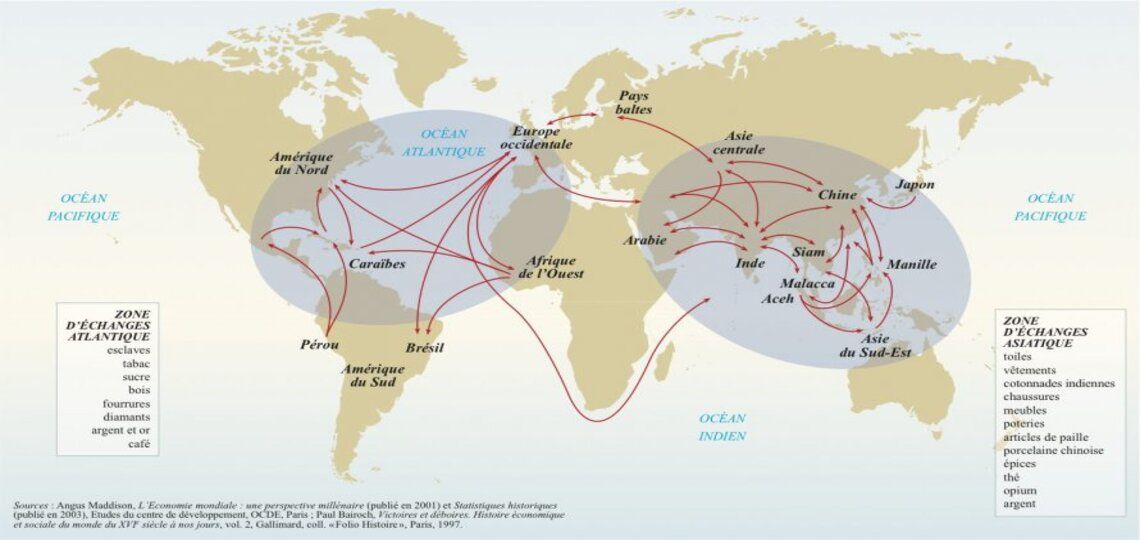

In recent years, the Arctic has been regularly presented as a “New Eldorado” for both trade and energy. The polar region is said to abound in resources, both hydrocarbon and renewable. What’s more, global warming has made the Arctic a faster passage for trade than traditional routes. The region thus became a land of covetousness, somewhat reminiscent of the era of the Great Discoveries.

The Arctic: one of the world’s largest reservoirs of hydrocarbons

In 2018, theUS Geological Survey reassessed the Arctic’s resources. The latest data dates back to 2008. It would seem that 29% of gas reserves and 10% of yet-to-be-discovered oil reserves are in the Arctic. This explains the strong interest shown by companies in this area.

Arctic resources are often overestimated. Extraction is possible, but requires advanced techniques, high costs and high risks. While some question the profitability of Arctic resources, large-scale projects are on the increase.

Total develops Arctic LNG 2: 19.8 million tonnes of LNG

Following the success of Yamal LNG, Total announced on April 21, 2021 thatArctic LNG 2 would be launched. This giant project is expected to produce some 19.8 million tonnes of liquefied natural gas (LNG) annually. Total is thus demonstrating its ability to produce major projects in the Arctic, on time and on budget.

Nevertheless, many multinational oil companies have withdrawn from Arctic offshore projects, believing them to be insufficiently profitable. In 2016, for example, Shell handed over its exploration land in the Canadian Arctic to an environmental NGO. In this way, Shell serves its reputation, while withdrawing from a project that is too costly, with too many operational risks.

These decisions, which are primarily economic in nature, are often presented as an illustration of the companies’ environmental concerns. Total has declared that it will no longer exploit offshore oil in the Arctic, because of the environmental risks involved. At the same time, the Group is the main customer for Russian Arctic oil, and is stepping up its LNG projects.

Exploiting the Arctic to develop renewable energies

In addition to its hydrocarbon resources, the Arctic could play an important role in the global energy transition. The Arctic is the region where research into renewable energies is most advanced. Hydroelectricity,wind power,hydrogen and geothermal energy are abundant resources in this area. They often complement each other, to ensure the continuity of power supply in different countries.

To be completely carbon-free, hydrogen has to be produced using resources such as hydroelectricity or geothermal energy. Green hydrogen is one of the few energies that is clean throughout its life cycle. It has the advantage of many uses, whether in industry or mobility.

HyPER’s Arctic hydrogen project

The Arctic HyPER project is a step in this direction: by 2030, Norway aims to build an international hydrogen supply chain. Its production would depend essentially on the country’s immense hydroelectric and wind resources. It would produce 500 tonnes of hydrogen every day, equivalent to an annual energy production of 7 TWh.

There are also volcanic zones in the Arctic with high geothermal potential. Iceland supplies 66% of its total energy needs from this resource. Eventually, it could export green electricity on a massive scale internationally, and in the form of hydrogen to facilitate transport.

Russia commits to renewable energies

Recently, the Novatek Ob Project has become ahydrogen project, whereas it was supposed to be a pillar of Russian LNG production. How can we explain this paradigm shift?

Faced with the predicted drop in demand for hydrocarbons, Russia is forced to adapt. Moscow is a pragmatic international player, promoting its own economic development. Hydrogen therefore appears to be a way of remaining competitive.

On the other hand, the proliferation of mining operations in all directions is likely to pose a real threat to the Arctic environment in the long term.

The Arctic in resource transport

With the recent accident involving the Ever Given freighter in the Suez Canal, discussions about alternative trade routes have resurfaced. Among them, the Arctic polar routes are often mentioned. The accelerated melting of Arctic ice since 2010 may open up new prospects for navigation.

40% faster than the Suez Canal

There are two main passages: the Northwest Passage (PNO) and the Northeast Passage (PNE). The first is located in the North American Arctic. The second runs along the Norwegian and Russian Arctic coasts.

One section of the PNE, the Route Maritime du Nord (RMN), is of particular interest. Freight would be 40% faster than through the Suez Canal. In addition to commercial shipping, it is above all energy transport that is beginning to benefit.

18 million tonnes of LNG transported by RMN

Last February, a Russian LNG carrier crossed the RMN section of the PNE for the first time in the middle of winter. The journey from Rotterdam to China took 11 days, two to three times less than the normal itinerary. This marks a breakthrough for the transportation of liquefied natural gas (LNG), production of which is steadily increasing in the Arctic.

“In 2020, almost 33 million tonnes of freight were transported along the Northern Sea Route, including over 18 million tonnes of liquefied natural gas,” adds the CEO of Sovcomflot, a Russian energy transport operator.

Alongside shipping, Moscow is investing heavily in infrastructure to transport energy to major importers. The Yamal-Europe pipeline, some 4,000 km long, links the Yamal gas fields to Western Europe.

A Total press release on the Yamal LNG project states: “Nearly 16.5 million tonnes of LNG will pass through the port of Sabetta (Siberia) every year. All LNG production is sold to European and Asian customers under 15-20 year contracts.

Alongside Europe, Sino-Russian cooperation in the energy sector is intensifying. The Power of Siberia is a major pipeline project linking Siberia to China. Commissioned in 2019, the expansion projects will provide annual gas export capacity of 38 billion m3. The Power of Siberia 2 expansion project would draw LNG directly from Russia’s Arctic territories.

The Canadian WNP: an example of a preserved Arctic

As a result, the Arctic is facing a general increase in maritime traffic and industrial activity. While Russia is multiplying large-scale projects in its Arctic territory, other states are trying to preserve this space.

In economic and commercial terms, the PNO seems unable to compete with the Russian PNE. One of the reasons for this is a lack of investment on Canada’s part. Due to the lack of development of this passage, traffic is limited to a few scientific and tourist vessels.

In this way, Canada is trying to establish a reasoned approach to economic development in the Arctic that takes environmental issues into account. With this in mind, Ottawa can now count on a new ally: Joe Biden. During the Climate Summit, he halted oil prospecting in Alaska. Donald Trump had granted these drilling permits at the end of his term.

The Arctic: a challenge for the future?

In the long term, the Arctic will represent a major environmental, energy and commercial challenge. Nevertheless, all this still seems a long way off. For the time being, the PNO is almost unusable, and the RMN is still limited to summer trips.

Resources have been overestimated, and exploiting them remains complex, costly and risky. While the Russian example illustrates the development potential of the Arctic territory, it also illustrates the dangers of unreasonable exploitation.