Since the rupture of a pipeline in February 2024, South Sudan, 90% dependent on its oil exports, has been experiencing an acute economic crisis. The pipeline, vital for transporting crude oil abroad, was damaged during the conflicts in Sudan, depriving the country of its main foreign exchange earnings. Moreover,oil supplies were already threatened in April 2023 by the current conflict.

The immediate consequence was a surge in inflation, coupled with the collapse of the South Sudanese pound. In the space of a few months, the exchange rate rose from 1,100 pounds to the dollar in February to 1,550 in July, worsening the economic situation of the population.

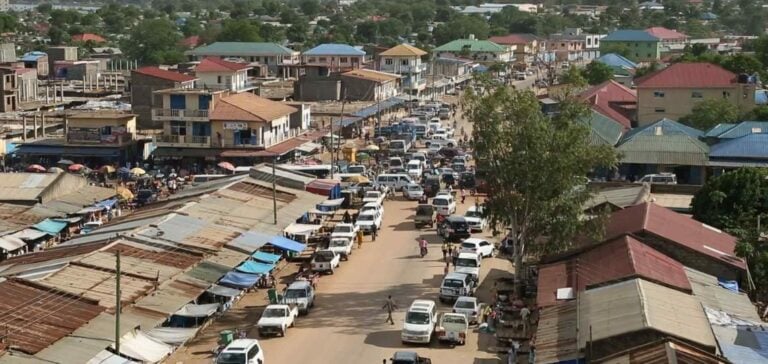

Daily life under pressure

Galiche Buwa, a 75-year-old widow, struggles to keep her grocery store afloat in the Konyo-Konyo market in the capital Juba. The drastic rise in prices has reduced her purchasing power and forced her to go into debt to buy supplies. This situation has repercussions for consumers, who have seen the price of basic foodstuffs such as corn soar from 800 to 2,000 pounds in just a few months.

Teddy Aweye, a mother of two, is a good example of how difficult it is to access basic necessities. Daily price fluctuations are forcing many people to forego essential purchases, exacerbating food insecurity in the country.

Effects on the small business sector

Abdulwahab Okwaki, a 61-year-old butcher, has noticed a marked drop in sales at his shop. Customers, hit by the crisis, are buying smaller quantities of meat, and many of his colleagues have already given up the business. Small businesses, like that of fashion entrepreneur Harriet Gune, are also feeling the pinch. The price rises needed to maintain inventories drive customers away, creating a vicious circle of rising costs and falling sales.

Impact on public finances

Government authorities are also feeling the effects of the crisis. In May, Awow Daniel Chuang, Minister of Finance, warned of the state’s inability to pay the salaries of the military, police and civil servants, due to a budget deficit caused by the loss of 70% of oil revenues. This situation further exposes the country to corruption and mismanagement of resources, chronic problems in South Sudan.

Anticipating future crises

South Sudan, which has been independent since 2011, urgently needs to diversify its energy infrastructure so that it is no longer solely dependent on the oil pipeline running through Sudan. According to economist and government advisor Abraham Maliet Mamer, the construction of refineries and pipelines via other countries could offer a lasting solution to this economic vulnerability. He stresses the importance of anticipating crises in order to stabilize the economy and improve living conditions for South Sudanese.

The conflict in Sudan, which has been going on since April 2023, has not only disrupted the oil infrastructure but also displaced millions of people, including over 700,000 refugees in South Sudan. This humanitarian crisis further exacerbates the country’s economic and social precariousness.