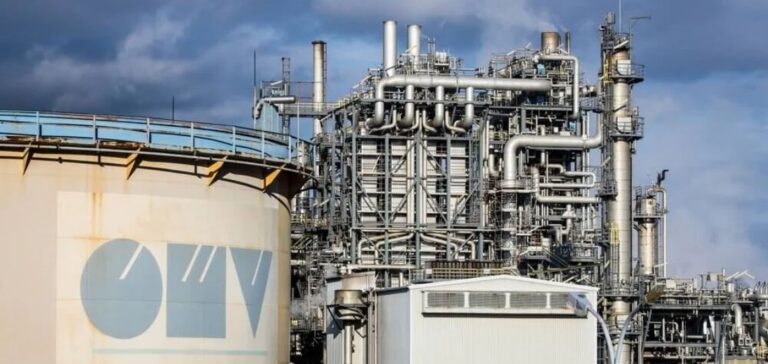

Energy producer and petrochemical group OMV has announced the final investment decision for a 140 megawatt (MW) electrolyser project in Bruck an der Leitha, Lower Austria. The facility is designed to produce up to 23,000 tonnes of green hydrogen annually. It will supply OMV’s Schwechat refinery and is expected to become operational by the end of 2027.

An industrial-scale project securing internal supply

This project follows the deployment of a 10 MW pilot unit inaugurated in 2024, also located at the Schwechat site. Developed in partnership with Kommunalkredit, the unit received certification as “Renewable Fuels of Non-Biological Origin” (RFNBO) under the European Renewable Energy Directive. The upcoming 140 MW electrolyser will draw on technical and operational insights gained from this initial project.

OMV plans to use only renewable electricity sources — wind, solar, and hydro — to power the facility. According to published estimates, the installation will enable a reduction in carbon dioxide (CO₂) emissions of approximately 150,000 tonnes per year, equivalent to the annual carbon footprint of 20,000 individuals.

A strategic link between chemical production and refining

At the same time, OMV inaugurated two pilot infrastructures in Schwechat: a 10 MW electrolyser and a ReOil® unit dedicated to chemical recycling of complex plastics. These facilities are intended to enhance the value chain from refining to petrochemical transformation and strengthen the integration between both processes.

According to Alfred Stern, Chairman of the Executive Board and Chief Executive Officer of OMV, this strategy forms part of the group’s 2030 roadmap, which aims for industrial transformation while maintaining competitiveness in the fuels and chemical products sector.

Positioning for European hydrogen auctions

The development of the electrolyser project is conditional upon a positive outcome in the auctions conducted by the European Hydrogen Bank and the Austrian Hydrogen Bank. OMV is targeting financial support in the mid three-digit million-euro range to ensure the project’s economic viability.

Martijn van Koten, Executive Vice President Fuels & Feedstock and Chemicals at OMV, stated that the new project will enable the company to meet a significant portion of its hydrogen demand at Schwechat while maintaining industrial continuity for its core product lines.