NexGen Energy Ltd has announced the closing of a global offering of common shares totalling approximately A$1bn ($639mn), split between the North American and Australian markets. The transaction aims to fund engineering, pre-production capital expenditures and general corporate needs for the Rook I uranium project located in the Canadian province of Saskatchewan.

A dual-continent transaction

On the North American market, the company issued 33,112,583 common shares at C$12.08 each, generating gross proceeds of C$400mn ($293mn). This portion of the offering was led by a syndicate of financial institutions including Merrill Lynch Canada Inc. as lead underwriter, along with Stifel Nicolaus Canada Inc., J.P. Morgan Securities Canada Inc., BMO Nesbitt Burns Inc., National Bank Financial Inc., RBC Dominion Securities Inc. and Canaccord Genuity Corp.

Simultaneously, NexGen placed 45,801,527 shares in the form of CHESS Depository Interests (CDIs) on the Australian market at A$13.10 per CDI, for total gross proceeds of A$600mn ($383mn). This tranche was underwritten by Aitken Mount Capital Partners Pty Ltd as sole underwriter and joint lead manager, alongside Canaccord Genuity (Australia) Limited.

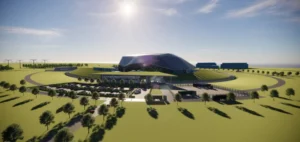

Targeted funding for Rook I

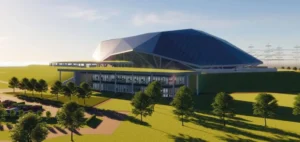

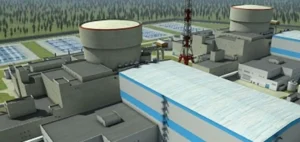

The proceeds will be used to advance engineering work at the Rook I site in the Athabasca Basin and to cover pre-production capital costs. The project, seen as one of Canada’s most advanced uranium initiatives, is currently in the preparation phase for potential construction.

The Australian shares were issued without a prospectus, in accordance with Australian legislation, targeting qualified or professional investors. The North American shares may not be sold in the United States unless registered or exempt under the U.S. Securities Act of 1933.

Cross-border legal coordination

The legal framework for the deal involved several firms. Farris LLP acted as primary legal counsel to NexGen. Dorsey Whitney LLP and Allens advised on the North American and Australian offerings respectively. The North American underwriters were represented by Blake, Cassels & Graydon LLP and Skadden, Arps, Slate, Meagher & Flom LLP, while Gilbert + Tobin advised the Australian underwriter.

The Rook I project comes amid renewed investment interest in uranium, driven by the reassessment of nuclear power in various regions. NexGen, listed on the Toronto, New York and Sydney stock exchanges, strengthens its financial base to advance a project considered strategic within Canada’s mining sector.