Iranian oil could replenish the market if the United States lifts sanctions. This possibility is currently under discussion in Vienna. Iran could thus return to the JCPOA, and OPEC could hand over production restrictions to Iran.

Iranian oil holds up despite failure to lift sanctions

Despite the failure to lift sanctions, Iran’s oil production has risen sharply in recent months. Before the imposition of sanctions by the Trump administration, Tehran could boast of producing 4 million barrels a day. As a result of this American policy of “maximum pressure”, the country saw its production decline sharply.

In July 2020, production reached an all-time low of 1.8 million barrels/day. Since then, the Iranian oil sector has seen a real rebound, with 2.4 million barrels produced per day. This figure is equivalent to Iranian production in April 2019 shortly after the end of the exemptions granted by the Trump administration.

Bypassing American sanctions

In other words, Iran has managed to maintain a high level of production, despite US sanctions. In addition, Iranian oil exports have been rising for several months, reaching their highest level since April 2019. According to some experts, exports were close to 600,000 barrels/day last March.

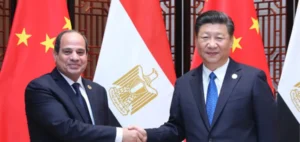

This performance is explained by the increasing circumvention of US sanctions by Iranian companies and their mainly Chinese partners. For example, the Iranians use open-ocean cargo transfers between tankers to avoid detection. They also mix their cargoes with Iraqi oil, making it very difficult to monitor exports.

Sanctions likely to be lifted at the end of May

The recent rebound in Iranian production is part of the ongoing negotiations for the return of the JCPOA. The oil issue is at the heart of discussions in Vienna between partners and Iranians. For Tehran, the United States must first implement a lifting of sanctions before returning to the agreement. Conversely, Washington demands that Iran return to the agreement first, before considering sanctions relief.

This zero-sum game seems to be coming to an end, with recent advances enabling an interim agreement to be reached before the Iranian elections. According to certain sources, Washington has agreed to be the first to return to the agreement by withdrawing certain sanctions. For their part, the Iranians have reportedly decided to drop their demands for the withdrawal of all sanctions.

Gradual lifting of restrictions

This agreement in principle would be based on a gradual lifting of restrictions affecting the Iranian oil sector. The Biden administration would grant a waiver to Iranian crude exports from June1. This exemption would be maintained until September to ensure that Teheran complies with the terms of the agreement.

Washington fears that the June elections will bring an ultra-conservative president to power, threatening the viability of the agreement. Temporary exemptions would serve as a tool of flexibility and pressure for the Biden administration in the event of a Conservative victory. However, the agreement provides for the definitive lifting of sanctions against the Iranian oil sector at the end of September.

What impact will this have on oil markets?

The interim agreement that seems to be taking shape between now and the end of May could therefore enable sanctions to be lifted. For Iran, this would undoubtedly boost its crude oil production and exports over the coming months. This prospect is all the more encouraging given that a number of countries, such as China, have already signed import contracts. Beijing and Teheran have just signed a 400 billion investment agreement over the next 25 years.

Nevertheless, Iranian exports are not expected to resume fully until September, once the sanctions have been definitively lifted. According to Platts, Iranian production is expected to increase by only 500,000 barrels/day between June and September. However, it should reach its pre-sanctions level of 4 million barrels/day by the1st half of 2022.

Production will depend on OPEC policies

However, this production scenario is likely to be hampered byOPEC‘s production quotas. For the time being, Teheran enjoys an exemption from the organization along with Venezuela and Libya. This means that Iran is not bound by OPEC+ quota allocations.

However, this situation could change if the country were to reach an agreement lifting restrictions on its oil sector. For OPEC, a very sharp rise in Iranian production could indeed lead to tensions over quotas. On the one hand, this would represent a loss of market share for countries bound by the OPEC + agreement. On the other hand, this could reduce production by other OPEC members if demand increases.

Indeed, to meet demand expected in the second half of the year, OPEC will have to increase its production quotas. However, if Iran returns to its pre-sanctions level, this will de facto limit the quotas allocated to other countries. This is why OPEC is closely monitoring the negotiations underway in Vienna. In the event of an agreement between Washington and Teheran, this could have a major impact on oil markets.