The global green hydrogen market is experiencing unprecedented growth momentum, supported by political initiatives, technological advances, and increasing industrial interest. According to SkyQuest Technology Consulting, the market, valued at USD 9.9 billion in 2024, could reach USD 510.8 billion by 2032, representing a compound annual growth rate (CAGR) of 63.8%. This pace is fueled by strategic investments in infrastructure, the expansion of electrolyzer deployment, and the diversification of industrial applications.

In the United States, federal levers play a central role in this expansion. The Inflation Reduction Act (IRA) and the dedicated program of the Department of Energy (DOE) provide billions in subsidies and tax credits to support the production and transportation of green hydrogen. The launch of seven regional hubs by the DOE aims to structure an industrial network, reduce costs, and accelerate adoption in energy-intensive sectors.

Rising Industrial and Logistics Applications

Heavy-duty transport, aviation, maritime shipping, and high-emission industries represent strategic outlets for green hydrogen. In 2024, the transportation segment dominated the global market, largely due to the development of hydrogen propulsion systems and fuel cell technologies. These applications address both the demand for energy security and emission reductions.

The pipeline segment has also emerged as the dominant distribution channel. Reusing existing natural gas infrastructure allows gradual integration of hydrogen, lowering logistics costs and facilitating industrial connectivity. This coupling with gas networks is particularly evident in pilot hydrogen-gas blending projects, such as the one launched by Torrent Group in India, with an annual capacity of 72,000 tons.

Electrolytic Technologies and Emerging Industrial Models

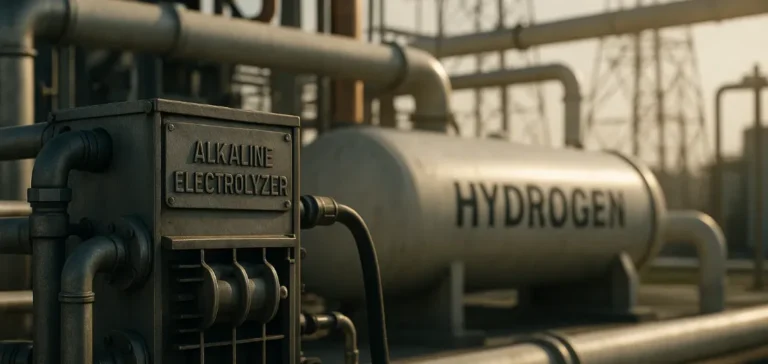

From a technological standpoint, alkaline electrolyzers represented the majority of installations in 2024. Their longer operating hours, compared to polymer electrolyte membrane (PEM) electrolyzers, provide greater profitability for large-scale projects. This trend is reinforced by private initiatives such as the partnership between Wison Engineering and Sungrow Hydrogen, which led to MegaFlex, a modular solution designed for rapid industrial deployment.

The evolution of industrial models now integrates synergies between renewable energy producers and green hydrogen manufacturers. Companies such as Plug Power, Cummins Inc., and Baker Hughes are investing in local supply chains, compression optimization, and production unit automation to strengthen the resilience of the North American market.

Technical Constraints and Operational Limits

Despite this momentum, several obstacles remain. The adoption of green hydrogen requires precise control infrastructure, advanced technical expertise, and costly adjustments to existing facilities. These technical requirements complicate modernization projects in cost-sensitive markets or in sectors with limited human resources.

Maintenance is also a key issue. Demanding industrial environments create significant wear constraints. Performance variability depending on the type of hydrogen requires specific maintenance protocols, increasing the risk of operational downtime. This reality hinders the integration of green hydrogen in remote areas or in industries where reliability remains a top priority.

Structuring Prospects and Strategic Development

Corporate strategies are shifting toward multi-sector cooperation to structure a coherent industrial sector. The convergence between hydrogen producers, network operators, and energy-intensive industries opens the possibility of rapid scaling, provided that financing is secured and technologies are standardized.

International development is also driven by high-visibility pilot projects. India, for example, is multiplying announcements of green hydrogen infrastructure, while China is showcasing new industrial equipment. These initiatives reflect a desire to consolidate the global value chain around this energy carrier, in response to economic imperatives and ongoing industrial restructuring.