As Indonesia’s energy demand continues to rise in tandem with its rapid economic growth, the country is turning towards nuclear power to secure its long-term energy supply. The Indonesian government plans to develop up to 10 gigawatts (GW) of nuclear capacity by 2040, integrating nuclear power into its national energy portfolio, which is currently heavily dependent on fossil fuels, especially coal and natural gas. This decision is part of a broader policy aimed at diversifying the country’s energy sources, reducing reliance on imported fuels, and achieving ambitious emission-reduction targets set by Jakarta. To implement this plan, Indonesia has initiated in-depth discussions with several major international players in the nuclear sector.

Key International Players Approached

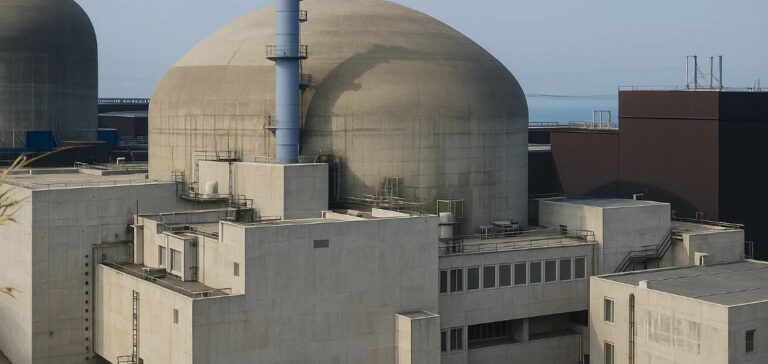

Several global companies have initiated discussions with Indonesian authorities, including Russian nuclear giant Rosatom, China National Nuclear Corporation (CNNC), British firm Rolls-Royce, France’s Électricité de France (EDF), and the American company NuScale Power, a specialist in Small Modular Reactors (SMR). The interest of these international firms primarily revolves around the construction and operation of nuclear power plants adapted to the geographic and seismic specificities of the Indonesian archipelago. While the government has not yet identified precise locations for these future facilities, several regions are currently under consideration. Among the main challenges highlighted are security considerations due to the country’s geographic location on the Pacific Ring of Fire, an area particularly prone to earthquakes.

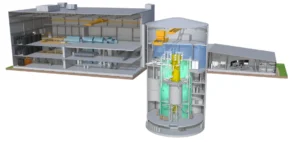

For now, the discussions remain preliminary, but the government aims to move swiftly to sign the first contracts within the next five years. The Indonesian nuclear regulatory agency, Badan Pengawas Tenaga Nuklir (BAPETEN), is already supervising the initial regulatory processes initiated by some candidates, such as ThorCon Power Indonesia. Recently, ThorCon submitted a licensing application to BAPETEN to deploy an innovative reactor based on Molten Salt Reactor (MSR) technology, viewed as particularly suitable for local environmental constraints.

Energy Strategy by 2040

The Indonesian government’s decision is part of an extensive program aimed at expanding the country’s total energy capacity by an additional 103 GW by 2040. Of this total, nuclear will account for approximately 10%, while renewable energy sources—including solar, wind, geothermal, and biomass—will represent around 75 GW, or about 73% of the new planned capacity. Natural gas will complete this ambitious plan with an additional capacity estimated at 18 GW.

This combined approach would enable Indonesia to sustain its economic growth while gradually reducing the role of coal, which currently accounts for about 60% of national electricity production. By decreasing its dependency on fossil fuel imports, Jakarta not only hopes to secure energy supply but also aims to stabilize energy prices for its industrial and domestic consumers. Indeed, the volatility of international coal and natural gas prices has frequently disrupted the country’s economic planning in recent years.

Economic and Technological Challenges

Although the economic potential of nuclear power is attractive to Indonesia, the actual implementation of this program will need to overcome several crucial milestones. One of the initial challenges will be securing the necessary financing for these major investments, potentially amounting to several tens of billions of dollars over a period of 15 to 20 years. The Indonesian government is currently exploring various financing options, including Public-Private Partnerships (PPP) as well as bilateral agreements with countries possessing advanced nuclear technologies.

The second challenge is technological, involving the need to adapt nuclear infrastructure to the geological and climatic particularities of the Indonesian archipelago. Innovative technologies such as modular reactors and molten salt reactors could offer suitable solutions, reducing both seismic risks and initial construction costs. Foreign companies involved hope to quickly demonstrate the technical and economic viability of their models to gain an advantageous position in this emerging market.

Regional and International Perspectives

Indonesia’s energy transition toward nuclear power could also reshape regional energy dynamics in Southeast Asia. Developing substantial nuclear capacities in the region’s most populous and economically dynamic country could prompt neighboring nations to seriously consider this option as well. This evolution could thus open new opportunities for international suppliers of nuclear equipment and services.

Additionally, the international community will closely observe the progress of this program, particularly Indonesia’s capability to comply with nuclear safety standards and manage radioactive waste disposal risks. Should the Indonesian model prove successful, it could become a case study for other emerging economies facing similar energy and economic challenges, potentially reinforcing the role of nuclear energy in the global energy transition.