First Lithium Minerals Corp. has launched a new exploration phase at its Lidstone project, located approximately 270 km north of the city of Thunder Bay in the province of Ontario. Fully owned by the company, the property spans 17,300 hectares and covers a 27 km greenstone belt within the English River sub-province of the Canadian Shield region.

A region with underexplored metallic potential

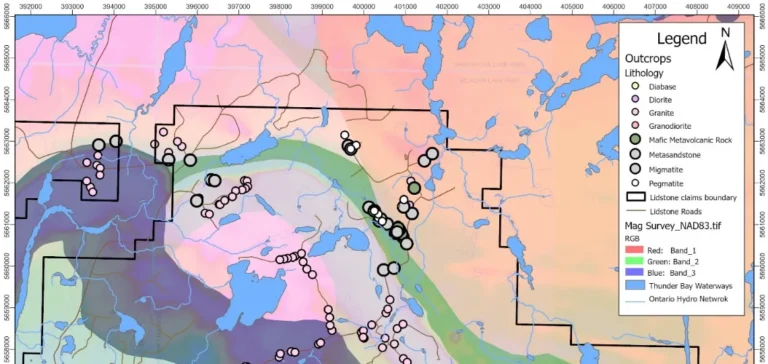

The site has seen little exploration activity in the past. However, regional magnetic surveys conducted by the Ontario Geological Survey (OGS) have revealed large-scale structural features. These may indicate potential for gold or base metal mineralisation. A previous sampling programme identified a quartz vein with a grade of 0.272 g/t gold in the northern part of the project.

Objective: identifying structures favourable to mineralisation

The field programme is focusing on the northern and central areas of the property, defined by contrasting magnetic intensities. Planned activities include prospecting, geochemical rock sampling and geological mapping. The goal is to identify structures, alteration zones or mineralised indicators compatible with the presence of gold or base metals. The company also plans to refine the interpretation of the belt using an airborne magnetic survey.

Towards drill preparation in 2026

The work is being conducted with the support of geoscience service firm Bayside Geoscience, based in Thunder Bay. Subject to weather conditions, the programme is expected to be completed by the end of Q4 2025. The results will enable First Lithium Minerals to define drill targets for the following year in a province known for its gold potential.

The Lidstone project carries no royalties and remains fully under the company’s control, as part of a strategy focused on critical metals value development.