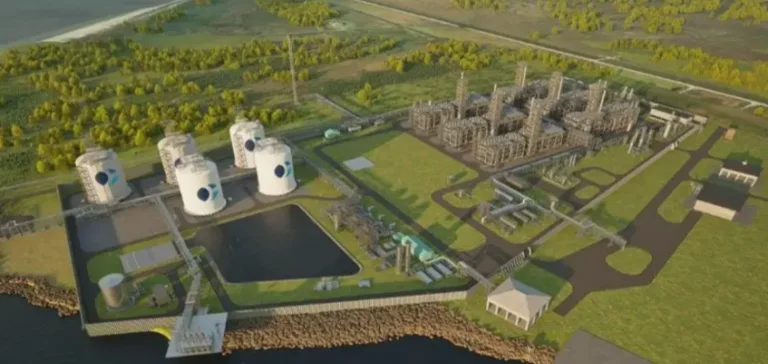

Commonwealth LNG has signed a sale and purchase agreement with EQT Corporation for the supply of one million tonnes per annum (Mtpa) of liquefied natural gas (LNG) over a period of twenty years. The volumes will come from the 9.5 Mtpa export facility currently under development in Cameron Parish, Louisiana.

Under the terms of the contract, the LNG will be sold on a free-on-board basis at a price indexed to Henry Hub, the benchmark for US natural gas. The agreement strengthens EQT’s position in the export chain, while providing Commonwealth with a long-term commercial foundation ahead of its final investment decision scheduled for 2025.

A structuring partnership for the Louisiana terminal

Commercial LNG production is expected in 2029. With this new agreement, Commonwealth LNG has now secured 5 Mtpa under long-term binding contracts, including previously announced commitments with Glencore, JERA and PETRONAS. These volumes account for more than half of the terminal’s planned capacity.

Executives from both companies highlighted the strategic alignment of the deal. EQT President and Chief Executive Officer Toby Z. Rice said the agreement with Commonwealth strengthens his group’s position in the global LNG market. Ben Dell, Chairman of Caturus, the parent company of Commonwealth LNG, pointed to the integrated “wellhead-to-water” model and modular design of the facility as differentiating elements.

Strengthened outlook on export markets

The announcement reflects the rising interest in North American export projects amid international demand for LNG. Commonwealth’s business model is based on streamlined execution and optimised costs, combined with indexed contracts, appealing to buyers looking to secure long-term supply.

The company stated it has advanced visibility to commit its remaining capacity. The site’s commissioning schedule, set for 2029, positions it to meet favourable market conditions, particularly in Asia and Europe, where diversification of supply remains a priority.