The federal government has conditionally approved CAD735,000 ($537,000) in funding for Arianne Phosphate Inc. under the Critical Minerals Research, Development and Demonstration (CMRDD) programme. The announcement is part of a broader CAD80.3mn ($58.9mn) package unveiled by Prime Minister Mark Carney during the 2025 G7 Summit, aimed at securing Canada’s supply chains in strategic raw materials.

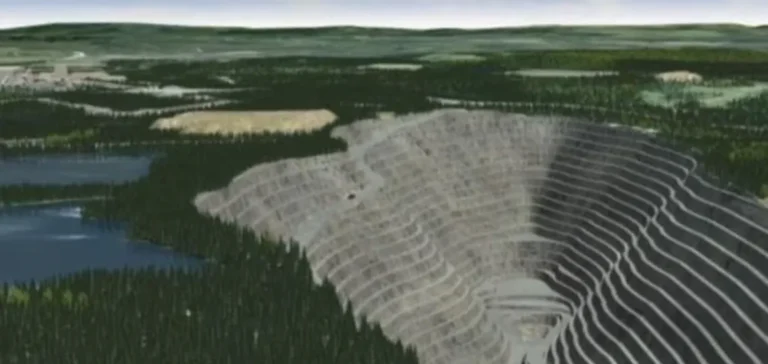

This funding will enable Arianne Phosphate to develop processes for treating ore from its Lac à Paul deposit, located in the Saguenay region of Quebec. The project focuses on optimising phosphoric acid purification, a key component in lithium-iron-phosphate batteries as well as fertilisers and specialised chemical products. The company aims to demonstrate the technical and commercial feasibility of Canadian-made phosphorus for industrial use.

Strengthening Canadian autonomy in critical materials

The federal investment is part of an industrial strategy to reduce reliance on imports and build domestic production capacity in strategic metals and materials. Phosphorus was officially added to Canada’s critical minerals list in 2024 due to its central role in energy storage technologies.

The subsidy granted to Arianne Phosphate will fund applied research work at its technology centre. If successful, the company could establish an integrated value chain around the Lac à Paul deposit, connecting to North American battery and agriculture markets.

A project aligned with a broader national strategy

Of the CAD80.3mn allocated by Ottawa, CAD50.3mn ($36.9mn) is specifically designated for domestic development, supply chain resilience, and response to market disruptions. The remaining funds aim to support international partnerships and modernise industrial capacities.

This funding complements the efforts of the Ministry of Energy and Natural Resources to structure a Canadian mining ecosystem aligned with the needs of the digital economy and clean technologies. By enabling the emergence of specialised operators such as Arianne Phosphate, the government seeks to increase national sovereignty over critical resources and foster innovation in the extractive sector.