The British nuclear industry, once a symbol of progress and innovation, now faces a colossal challenge: decommissioning its facilities. This process, which is not only costly but also protracted, raises crucial questions about the economic and environmental viability of nuclear power.

Cost Comparison: Nuclear vs Renewable Energy

The UK’s nuclear program, initiated between 1957 and 1995, led to the construction of 14 reactors, now shut down, and 9 still in operation. Designed mainly around two models – the Magnox and the AGR – these reactors were initially intended for both electricity production and, in some cases, the manufacture of weapons-grade plutonium. However, the profitability of these reactors has been called into question, especially in comparison with more economical and environmentally-friendly alternatives such as wind and solar power.

The Magnox reactors, of medium capacity (350MW) and oriented towards plutonium production, generated expensive electricity. The AGR model, subsequently designed for larger capacities (around 1.2GW), aimed for greater thermal efficiency, but with production costs that were still high.

The Future of Energy in the UK: Rethinking Nuclear Strategy

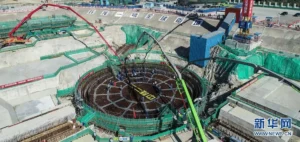

The UK government’s recent decision to support the construction of two new EPR reactors at Hinkley Point C, despite their unproven design, considerable delay and a budget 50% higher than originally forecast, is raising concerns. These reactors, while promising in terms of capacity (3.2GW cumulative), satisfy only one of the conditions necessary for the success of a modern nuclear program.

High Costs of Nuclear Decommissioning: A Burden for the Future

Furthermore, the cost of dismantling the 23 existing reactors and the two reactors under construction at Hinkley Point C is surprisingly high. According to the UK Nuclear Decommissioning Authority (NDA), the cost would be around €149 billion by the end of 2022. Stephen Thomas, Professor of Energy Policy at the University of Greenwich, even estimates that costs could reach €260 billion, based on current cost trends.

The Reality of Nuclear Costs Compared to Renewable Alternatives

This situation highlights the real, often underestimated, cost of nuclear power. While the industry often claims that nuclear power is an economic option, these figures show otherwise. What’s more, a comparison with renewable energies such as offshore wind and solar power reveals an even greater disparity. For example, decommissioning costs for a wind or solar farm on a GW scale are much lower, in the tens of millions of euros, compared with billions for nuclear power.

It is therefore crucial to reconsider the place of nuclear power in the UK’s energy strategy, especially at a time when more affordable and environmentally-friendly alternatives are available. The transition to more sustainable and cost-effective renewable energy sources is becoming a key priority for the UK’s and the world’s energy future.

Dismantling the UK’s nuclear fleet reveals the hidden costs and environmental challenges of nuclear power. As the world turns to more sustainable energy solutions, the UK needs to rethink its energy strategy, focusing on more economical and environmentally friendly alternatives such as wind and solar power.