Enel shareholders, meeting Wednesday at a general meeting in Rome, voted by a large majority in favor of Giorgia Meloni’s government candidate for the position of chairman of the board of the Italian energy giant. A total of 97.24% of the capital represented at the meeting gave its vote to the government candidate, Paolo Scaroni, 0.66% of the votes were unfavorable and 2.08% of shareholders abstained.

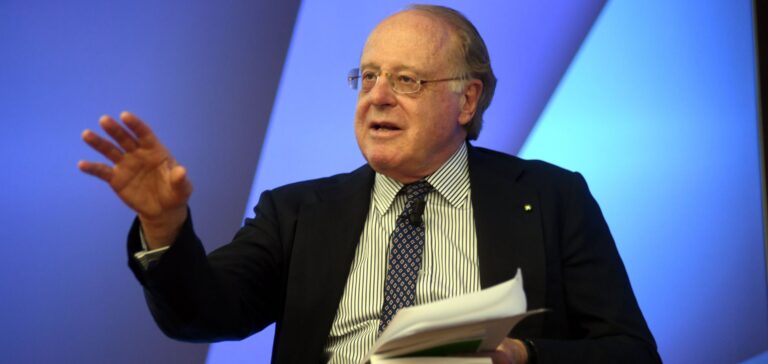

The Italian state owns 23.6% of Enel. Paolo Scaroni, president of the AC Milan soccer club, is close to Silvio Berlusconi and knows Enel well, having been its CEO from 2002 to 2005. The controversial figure has often been criticized for his close ties to Moscow that he forged during his tenure as CEO of Italian hydrocarbon group Eni, which ended in 2014. In September 2022, Mr. Scaroni, 76, had denounced “the escalation of sanctions” against Russia decided by the West in the wake of the invasion of Ukraine by Moscow’s troops.

The Meloni government, which has placed several of its loyalists at the head of public companies, was facing an unprecedented rebellion by some of Enel’s shareholders against the candidacy of Mr. Scaroni. The rebellion was led by the investment fund Covalis Capital, which had proposed the Italian banker Marco Mazzucchelli as chairman to counter the influence of the ultra-conservative government within Enel. But Mr. Mazzucchelli could not run against Mr. Scaroni, because the candidates on the Covalis list did not receive enough votes to be elected as board members.

Turning the corner on sustainable development

Zach Mecelis, founder of Covalis, which owns about 1% of Enel, had denounced the “opacity of the process” of choosing government candidates and had assured to present a list that “better reflects the international DNA of the company”. The list presented by the Ministry of the Economy obtained 49.1% of votes in favor and its six candidates will join the board of directors, including Flavio Cattaneo, whom the government had appointed CEO. The other three members of the board are from the Assogestioni list, which brings together Italian institutional investors and received 43.5% of the votes. “We have obtained an excellent result, better than three years ago” during the last vote in assembly on the government list, commented the Minister of Economy Giancarlo Giorgetti.

Flavio Cattaneo, 59, executive vice president of the private rail operator Italo-NTV, will be called upon to replace Francesco Starace, CEO of Enel since 2014 and whose third term is expiring. Under Mr. Starace’s leadership, Enel was one of the first energy companies to embrace sustainability, a commitment that has not been high on the agenda of the Meloni government. Glass Lewis, a leading U.S. shareholder advisory firm, had called for a vote for Mr. Mazzucchelli to offset the presence of the government’s chosen CEO. The Norwegian sovereign wealth fund, which owns 2.2% of Enel, also defended the candidacy of Mr. Mazzucchelli, in order to “strengthen the independence of the board of directors”.