German energy company RWE has filed an arbitration case against Gazprom to be compensated for cuts in Russian gas supplies to Germany, a spokeswoman said Tuesday, days after a similar announcement by Uniper Group.

“We have taken the necessary legal steps,” a spokeswoman said in a statement sent to AFP, without giving further details on the amounts requested.

An arbitration tribunal has been set up, she said.

The group had signed a contract with Russia’s Gazprom for the delivery of 15 terawatt hours of gas in 2022.

Some of these contracts have not been honored, due to the reduction since June, then the total end since September, of Russian gas deliveries via the Nord Stream pipeline, against the backdrop of the war in Ukraine.

In order to supply its customers, the German company had to buy on the short-term spot markets, where prices exploded during the summer.

However, RWE’s situation is better than that of the Uniper Group, Germany’s largest importer, which used to buy almost 200 terawatt hours of Russian gas annually.

Uniper, nationalized by the German state, announced last Wednesday that it was taking Gazprom to an arbitration tribunal.

The group is demanding at least 11.6 billion euros in compensation from the Russian giant.

Gazprom invoked this summer a case of “force majeure” to justify the cessation of its deliveries, without giving further details.

Invoking “force majeure” allows a company to be released from its contractual obligations by exonerating it from any legal liability.

The event mentioned must be particularly unforeseeable, independent of the company’s will and preventing it from fulfilling its obligations.

Uniper and RWE have denied this claim since the beginning of the crisis.

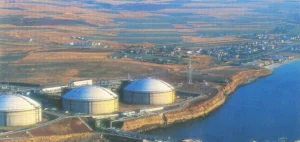

In late September, explosions off the coast of Denmark and Sweden destroyed entire sections of the Nord Stream 1 and 2 pipelines, making delivery effectively impossible.

The hypothesis of sabotage is favored by the Danish, German and Swedish judicial authorities, who have launched an investigation.

Russia denies being at the origin of this incident.