Next Hydrogen Solutions Inc. has closed a non-brokered private placement of CAD$20.7mn ($15.45mn), issuing over 46 mn common shares at CAD$0.45 each. The transaction, led by Smoothwater Capital Corporation, makes the latter the largest shareholder with a 47.9% stake, ensuring the company remains Canadian-controlled.

Strategic change in control

The capital raise comes with a governance shift. Stephen Griggs, Chief Executive Officer of Smoothwater, has been appointed Executive Chair of the Board, while Paul Currie, advisor during the placement, also joins the board. At the same time, Susan Uthayakumar has stepped down. The creation of a new control person was approved in writing by disinterested shareholders, in line with TSX Venture Exchange (TSXV) policies.

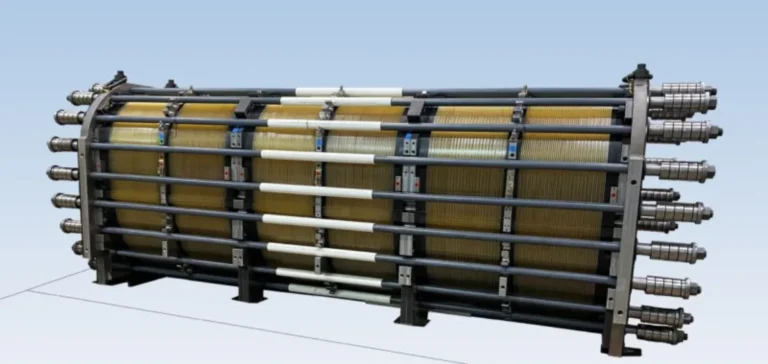

Roadmap focused on the NH-150 product

The funds will be used to support scaling up production and sales of the NH-150 system, already deployed at a paying customer site. The company will also continue development of the larger-capacity NH-500 model to address industrial demand. The strategy is based on a capital-light modular model, combining in-house stack design and external partnerships for high-volume assembly.

Debt exchanges and debenture conversions included in the deal

In addition to cash proceeds, Next Hydrogen completed debt exchange agreements totalling CAD$560,527 and CAD$1.125mn in debentures, issuing around 3.7 mn shares at CAD$0.45 per share. These steps reduced liabilities while avoiding fees or brokerage commissions.

Regulatory progress and tax incentives in Canada

Canada continues to advance supportive policies, including investment tax credits of up to 40% for eligible clean hydrogen projects. This regulatory backing strengthens the ability of local firms to compete globally while supporting national energy security. Next Hydrogen aims to leverage this momentum to accelerate technology deployment.