Norwegian state-owned producer Statkraft has formalised the sale of part of its renewable energy portfolio in India to Serentica Renewables, an independent power producer based in Mumbai. The agreement covers installed and developing capacity totalling 1.5 gigawatt-peak (GWp) located in the state of Rajasthan, including a 445 MWp solar power plant already in operation.

A mixed portfolio already operational and under development

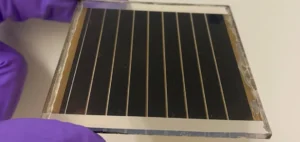

The transaction includes the operational Khidrat asset of 445 MWp commissioned earlier this year, along with a pipeline of solar and wind projects under development representing approximately 1,000 MWp. Completion of the deal remains subject to standard precedent conditions, including the receipt of regulatory approvals. No financial details regarding the value of the sale were disclosed.

According to Statkraft, the transfer allows continuity for impacted employees while ensuring the further development of the assets under new management. Serentica Renewables stated that the acquisition would accelerate its strategy to provide large-scale dispatchable renewable power.

Strategic shift for Statkraft

The sale is part of a broader repositioning by Statkraft, which announced in 2024 its intention to exit the Indian market. The company now focuses its investments on strategic markets in Europe and South America, aiming to scale operations and strengthen its competitiveness in these regions.

Active in India since 2004 through its joint venture SN Power, Statkraft was one of the first foreign investors in the country’s hydropower sector. Over two decades, the group built a diversified portfolio including hydro, solar, and wind assets, along with a power trading presence in several Indian states.

Rapid expansion of Serentica Renewables

Founded in 2022, Serentica Renewables has quickly reached 1,000 MW of renewable energy capacity, with ongoing projects across several regions. Backed by a $650mn investment from KKR, the company aims to supply over 50 billion units of clean energy annually, primarily targeting hard-to-abate industrial sectors.

Statkraft remains engaged in the global energy transition but will now allocate capital to regions where it can scale more effectively. This strategy aims to deliver greater impact in its core markets.