Tokyo Electric Power Company Holdings, Inc. (TEPCO) reported a net loss of $5.83bn (JPY857.6bn) for the first quarter of fiscal year 2025, reflecting the significant impact of costs related to post-accident nuclear management. The operator attributed this result mainly to increased expenses for compensation and preparations for nuclear debris removal operations.

Exceptional costs linked to nuclear management

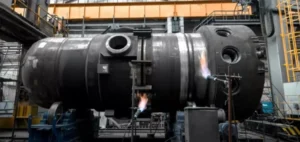

TEPCO stated that expenses dedicated to nuclear damage compensation reached $350mn (JPY51.9bn) for the period. At the same time, the group set aside $6.14bn (JPY903.0bn) for preparation work related to the extraction of damaged nuclear fuel, a cost item that now represents a significant share of its outlays. This increase in costs highlights the financial burden of the aftermath of the nuclear accident in Japan.

TEPCO’s net revenues for the quarter amounted to $9.72bn (JPY1.43tn), down from $10.13bn (JPY1.49tn) recorded in the same period of the previous fiscal year. The decline in sales, combined with increased post-accident management charges, has placed considerable pressure on the group’s profitability.

Uncertainty over nuclear restart

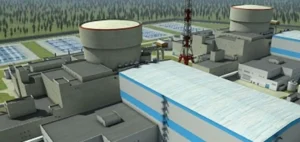

The company specified that its annual earnings forecast remains undetermined, as uncertainty persists over the resumption of commercial activities at the Kashiwazaki-Kariwa Nuclear Power Plant. According to TEPCO, an announcement regarding financial projections will be made as soon as operational conditions allow for a determination of the timeline.

TEPCO continues its efforts to meet regulatory requirements and enhance the safety of its facilities. Investments in fuel management and compliance with national standards remain a major expenditure in the group’s overall strategy.

Authorities are closely monitoring the evolution of the situation, while the sector is focused on compensation mechanisms and the medium-term economic consequences. A TEPCO representative highlighted the priority given to safety and transparency in the communication of the group’s financial information.