- Focus

Minnesota’s public regulator has approved the $6.2bn acquisition of energy group Allete by BlackRock and the Canada Pension Plan, following adjustments aimed at addressing rate concerns.

The Swiss chemical group faces two new lawsuits filed in Germany, bringing the total compensation claims from oil and chemical companies to over €3.5bn ($3.7bn) in the ethylene collusion case.

The US Supreme Court will hear ExxonMobil’s appeal for compensation from Cuban state-owned firms over nationalised oil assets, reviving enforcement of the Helms-Burton Act.

A major fire has been extinguished at Chevron’s main refinery on the US West Coast. The cause of the incident remains unknown, and an investigation has been launched to determine its origin.

Chevron has appointed Bank of America to manage the sale of pipeline infrastructure in the Denver-Julesburg basin, targeting a valuation of over $2 billion, according to sources familiar with the matter.

Eight OPEC+ countries are set to increase oil output from November, as Saudi Arabia and Russia debate the scale of the hike amid rising competition for market share.

Hungary has signed a ten-year agreement with Engie for the annual import of 400 mn m³ of liquefied natural gas starting in 2028, reinforcing its energy diversification strategy despite its ongoing reliance on Russian gas.

Wanted by Germany for his alleged role in the 2022 sabotage of the Nord Stream pipelines, a Ukrainian has been arrested in Poland and placed in provisional detention pending possible extradition.

The potential removal by Moscow of duties on Chinese gasoline revives export prospects and could tighten regional supply, while Singapore and South Korea remain on the sidelines.

The containment structure over Chernobyl’s destroyed reactor lost power after a Russian strike, as Zaporizhzhia remains cut off from external electricity for over a week.

An unprecedented overnight offensive targeted gas infrastructure in Ukraine, damaging several key facilities in the Kharkiv and Poltava regions, according to Ukrainian authorities.

Vladimir Putin responded to the interception of a tanker suspected of belonging to the Russian shadow fleet, calling the French operation “piracy” and denying any direct Russian involvement.

France intercepted a tanker linked to Russian exports, prompting Emmanuel Macron to call for a coordinated European response to hinder vessels bypassing oil sanctions.

Facing a potential federal government shutdown, multiple US energy agencies are preparing to suspend services and furlough thousands of employees.

A report reveals the economic impact of renewable energy losses in Chile, indicating that a 1% drop in curtailments could generate $15mn in annual savings.

The Clean Hydrogen Partnership has closed its first call for Project Development Assistance (PDA), totaling 36 applications from 18 countries. Results are expected in October, with support starting in November.

EDF power solutions and El Paso Electric have started operations at the Milagro Energy Center, combining 150 MW of solar photovoltaic capacity and 75 MW of battery storage under a 20-year power purchase agreement.

Uranium deliveries to U.S. civilian operators rose 8% in 2024, while the average price climbed to its highest level since 2012, according to the latest available data.

Coal will temporarily become the main source of electricity in the Midwest markets MISO and SPP during winter, according to the latest federal forecasts.

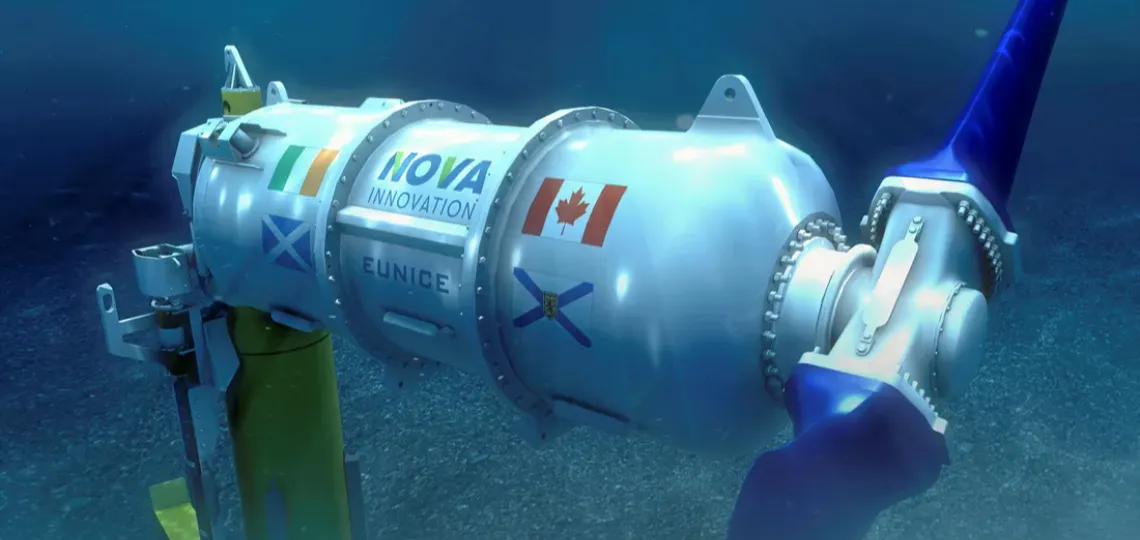

The 600MW submarine interconnection between Tunisia and Italy enters its construction phase, marking a logistical and financial milestone for the Euro-Mediterranean electricity market.

- Last news

International Petroleum Corporation has completed its annual common share repurchase programme, reducing its share capital by 6.2% and is planning a renewal in December, pending regulatory approval.

Kandla port plans a 150,000-ton-per-year integrated renewable methanol unit, targeting the growing fleet of compliant vessels on the Singapore-Rotterdam maritime route.

An international tribunal ruled in favour of French company Orano against the State of Niger, which had blocked the sale of uranium extracted from the Arlit mine since taking control of the site in 2023.

US-based Oklo and Sweden’s Blykalla join forces to coordinate supply chains and regulatory data sharing to accelerate the commercial deployment of their metal-cooled small modular reactors.

Energy group Axpo is considering a new installation of three wind turbines in Wil, aimed at powering around 5,000 households and strengthening Switzerland's winter electricity production.

Sun Investment Group has launched a crowdfunding campaign with Enerfip to raise up to €1.6mn ($1.7mn) to support the development of twelve photovoltaic plants in Italy totalling 113 MW.

Encavis strengthens its wind portfolio in Germany with the acquisition of a Schierenberg project and the signing of four new partnerships with ABO Energy, for a joint total capacity of 106 MW.

OMV is investing several hundred million euros in a 140 MW electrolysis unit in Austria, set to produce 23,000 tonnes of green hydrogen annually to supply its Schwechat refinery.

Shell UK has started production at the Victory field north of Shetland, integrating its volumes into the national gas network through existing infrastructure to strengthen UK supply.

The three countries will hold a meeting in October to unlock interconnector projects, following a major blackout that exposed the fragility of the Iberian Peninsula’s electricity integration.

Boralex rolls out an energy assistance scheme for residents near its wind and solar farms, with a pilot project launched in two communes in Haute-Loire.

TotalEnergies plans to increase its energy production by 4% annually until 2030, while reducing global investments by $7.5bn amid what it describes as an uncertain economic environment.

EDF plans a massive €25bn ($26.5bn) investment to modernise its nuclear fleet, focusing on reactor lifetime extension and preparing for new nuclear projects in France.

Subsidised bio-LNG is gaining traction in European maritime transport, supported by strong demand and a narrowing price gap with unsubsidised volumes.

Exxon is seeking direct support from the Mozambican government to secure its Rovuma LNG project, as Islamist violence continues to hinder investment in the country’s north.

Up to 55% of Europe’s electricity system remains vulnerable due to weak interconnection capacity, increasing the risk of widespread outages in several countries, according to a new report.

Chevron has signed a $690 million agreement with Equatorial Guinea to develop gas from the Aseng field, amid a long-term decline in national oil production and a search for new economic drivers.

The Trump administration plans to open millions of federal hectares to coal and ease environmental rules governing this strategic industry.

Eiffage, through its Belgian subsidiary Smulders, will build three electrical substations to connect offshore wind farms in Brittany and the Mediterranean, under a contract exceeding €1.5bn ($1.59bn).

Faced with growing threats to its infrastructure, Denmark raises its energy alert level in response to a series of unidentified drone flyovers and ongoing geopolitical tensions.